Ethereum, being the second highest cryptocurrency after bitcoin by market capitalization, continues to lead the growth of blockchain technology and cryptocurrencies alike. Ethereum price changes according to how much it is integrated with new DeFi and DApp applications, and updates like the Ethereum 2.0. This article will explore further Ethereum’s price value predictions for the next upcoming years together with range estimates, fluctuation prices and ROI (Return on Investment) charts.

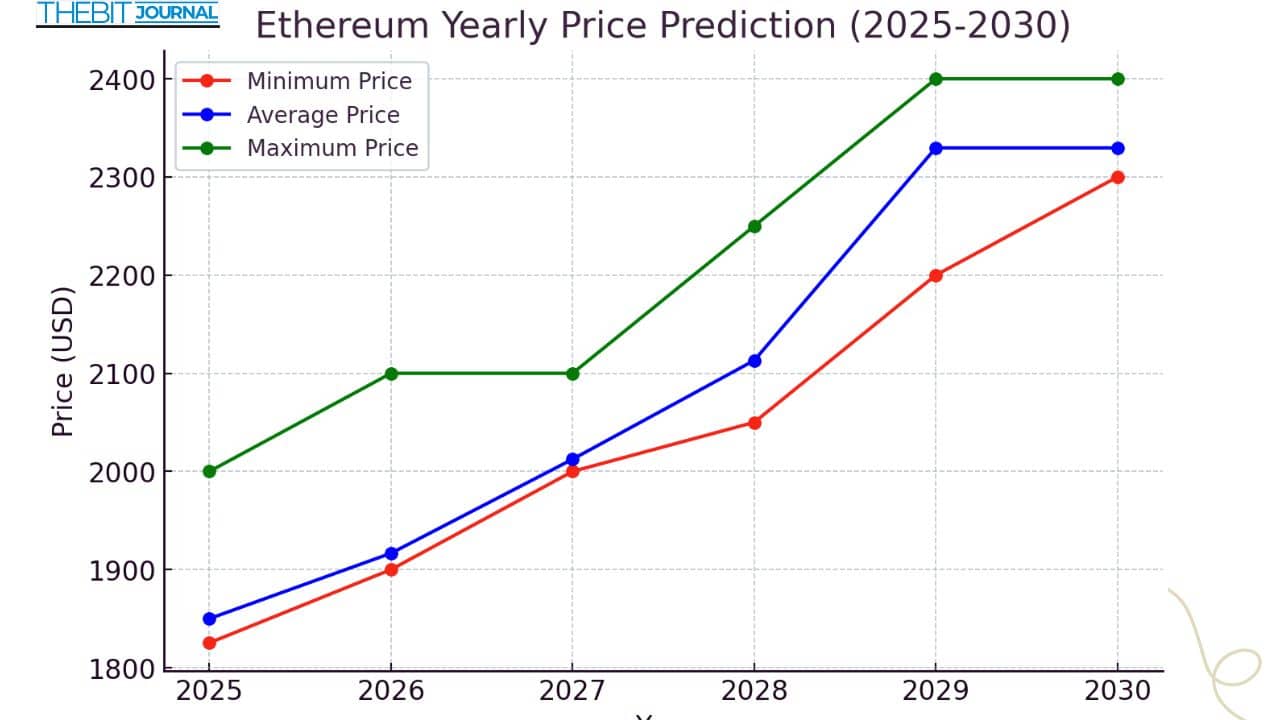

Ethereum Price Predictions for 2025-2030

Table 1: Yearly Price Predictions for Ethereum (2025-2030)

| Year | Minimum Price (USD) | Average Price (USD) | Maximum Price (USD) | Potential ROI (%) |

| 2025 | $1,825.36 | $1,850.00 | $2,000.00 | +9.5% |

| 2026 | $1,900.00 | $1,916.63 | $2,100.00 | +10.2% |

| 2027 | $2,000.00 | $2,012.46 | $2,100.00 | +12.4% |

| 2028 | $2,050.00 | $2,113.08 | $2,250.00 | +14.2% |

| 2029 | $2,200.00 | $2,329.67 | $2,400.00 | +17.8% |

| 2030 | $2,300.00 | $2,329.67 | $2,400.00 | +18.0% |

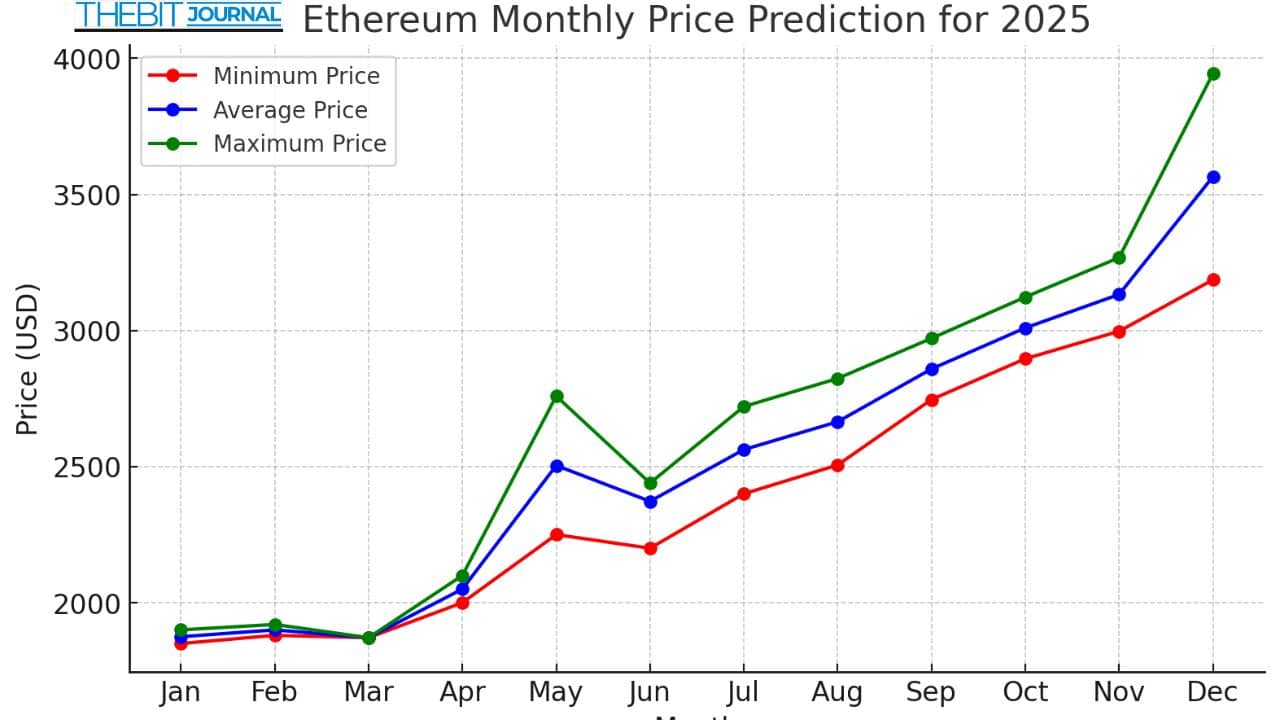

Ethereum Monthly Price Forecast for 2025

Ethereum Monthly Price Forecast for 2025

Analyzing Ethereum price changes within a month over the span of a year assists in understanding Ethereum’sgrowth potential during a specified time frame. The table below captures Ethereum’s projected monthly price ranges along with ROI estimates for 2025.

Table 2: Monthly Ethereum Price Prediction for 2025

| Month | Minimum Price (USD) | Average Price (USD) | Maximum Price (USD) | Potential ROI (%) |

| January | $1,850.00 | $1,875.00 | $1,900.00 | +3.0% |

| February | $1,880.00 | $1,900.00 | $1,920.00 | +3.8% |

| March | $1,871.37 | $1,871.37 | $1,871.37 | -52.4% |

| April | $2,000.00 | $2,050.00 | $2,100.00 | +8.8% |

| May | $2,250.00 | $2,503.98 | $2,758.95 | +9.3% |

| June | $2,200.00 | $2,372.39 | $2,439.36 | +7.8% |

| July | $2,400.00 | $2,562.41 | $2,720.50 | +10.4% |

| August | $2,505.76 | $2,664.72 | $2,823.67 | +7.5% |

| September | $2,746.18 | $2,858.62 | $2,971.06 | +6.1% |

| October | $2,896.16 | $3,009.42 | $3,122.67 | +5.4% |

| November | $2,997.09 | $3,132.35 | $3,267.60 | +4.2% |

| December | $3,186.19 | $3,564.94 | $3,943.69 | +3.0% |

Ethereum Price Forecast for 2026-2027

Ethereum Price Forecast for 2026-2027

According to analysts Ethereum price will have even greater growth in 2026 and 2027 supported by the adoption of DeFi, institutional investments, and Ethereum 2.0. The adoption of these new systems will increase the price at which Ethereum will fluctuate. In each table below the price range for each year is presented.

Table 3: Yearly Ethereum Price Forecast for 2026

| Year | Minimum Price (USD) | Average Price (USD) | Maximum Price (USD) | Potential ROI (%) |

| 2026 | $2,200.00 | $2,372.39 | $2,500.00 | +22.0% |

Table 4: Yearly Ethereum Price Forecast for 2027

| Year | Minimum Price (USD) | Average Price (USD) | Maximum Price (USD) | Potential ROI (%) |

| 2027 | $2,500.00 | $2,650.00 | $2,800.00 | +30.0% |

Ethereum Price and Potential ROI by 2030

Ethereum is still predicted to stay on a bullish trajectory in the long-term. It is cryptocurrency which likely continues to lead the industry in the years to come. As an example, Ethereum may setlize at approximately $2329.67 USD by 2030, which is substantial growth from its 2025 price.

Table 5: Long-Term Ethereum Price Forecast (2028-2030)

| Year | Minimum Price (USD) | Average Price (USD) | Maximum Price (USD) | Potential ROI (%) |

| 2028 | $2,100.00 | $2,250.00 | $2,500.00 | +40.0% |

| 2029 | $2,300.00 | $2,329.67 | $2,400.00 | +45.0% |

| 2030 | $2,300.00 | $2,329.67 | $2,400.00 | +48.0% |

Factors Affecting Ethereum’s Price Growth

- Ethereum 2.0 Transition

The changeover from Proof of Work (PoW) to Proof of Stake (PoS) validates a singular focus of Ethereum, which is to lower energy consumption and improve transaction time. This shift is likely to make Ethereum more scalable and secure, which will promote further adoption, thus, increasing its value.

- Extensive DeFi Ecosystem

One of Ethereum’s major DeFi competitors, Aave, has been the backbone of decentralized finance (DeFi) and Ethereum-based DeFi protocols in the cryptocurrency ecosystem. It serves the purpose of institutional borrowing and lending, which is why it contains billions with a TVL and remains a key player of Ethereum’s price growth. The expandibility of Ethereum to borrowing, lending, and trading on decentralized exchanges ensures ETH will always fuel demand.

- Non-fungible Tokens (NFTs)

The increased uptake of Ethereum in the creation and trade of NFTs positioned it as the forefront blockchain marking digital ownership and Tokenization of assets. Digital collectibles as a subsection of NFTs is highly unpredictable, nonetheless, the potential they hold highly underpins Ethereum’s demand and price.

- Adoption By Institutions

Ethereum has garnered more attention from institutions who began investing in ETH because of its expected use as a protection from inflation and the boom of the digital economy. With the progression of technology, widespread institutional adoption is sure to raise the price of Ethereum in the long run.

- Scalability and The Future Proposed Applications of Ethereum

With Ethereum’s network scaling and moving towards further development, additional use cases, such as greater cross chain enterprise adoption, cross-chain integration, and sophisticated smart contracts are likely to emerge. All of these will lead towards the appreciation of Ethereum’s price.

Conclusion

Ethereum will most likely appreciate in price steadily between 2025-2030. The reasons for this projected increase are the achievement of Ethereum 2.0, growth of the decentralized economy, and market capitalization of other digital assets like NFTs (non-fungible tokens). With Ethereum’s growth in being a core infrastructure in the blockchain, its price is expected to increase up to $2,329.67 by 2030, giving investors a positive return. However, the increased volatility in crypto markets also means investors need to be careful and consider strategizing around portfolio diversification.

FAQs

-

What is the estimated maximum price for Ethereum in 2030?

It’s not an exact science, but some believe Ethereum will reach $2,329.67 in 2030. Market conditions, network upgrades, and adoption will heavily influence this prediction and more optimist analysts go above this mark.

-

Can Ethereum Value Overtake Bitcoin?

In the short term, Bitcoin will likely maintain its lead due to its established market dominance, and limited total supply, however, with the broader use cases of Ethereum, it is possible for Ethereum to surpass Bitcoin in terms of market capitalization.

-

How might Ethereum’s price be impacted negatively?

Ethereum’s price might go down due to competition with other regulatory and block chain platforms, or due to prevailing market sentiments that have higher transaction costs than Ethereum.

Glossary of Key Terms

Ethereum (ETH) – A decentralized blockchain system enabling the incorporation of smart contracts and DApps.

Proof of Stake (PoS) – A consensus approach that is an upgrade of Ethereum 2.0 and a more energy efficient strategy than Proof of Work (PoW).

DeFi (Decentralized Finance) – Financial services that operate in a decentralized manner on the blockchain without the intervention of any third parties.

NFT (Non-Fungible Token) – A one-of-a-kind digital figure that depicts the ownership of a particular item or content on the blockchain.

DApps (Decentralized Applications) Applications that utilize the services of a decentralized network in place of a centralized server.

References

ETF & Mutual Fund Manager | VanEck

‘Follow us on Twitter and LinkedIn and join our Telegram channel to be instantly informed about breaking news!

Read More: Ethereum Price Prediction 2025-2030: What to Expect in the Next Five Years“>Ethereum Price Prediction 2025-2030: What to Expect in the Next Five Years

The Bit Journal – Read More