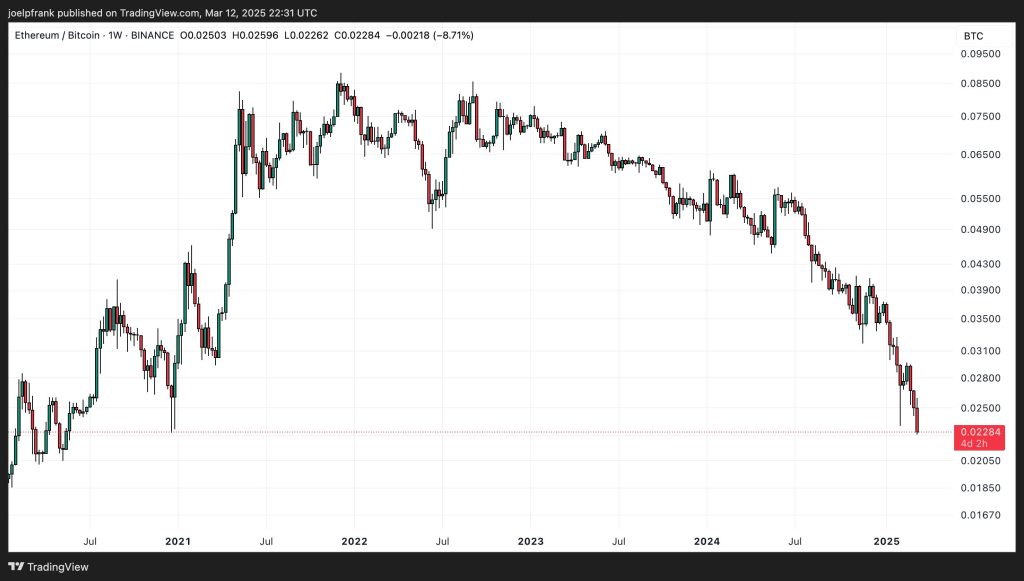

ETH investors are in despair as they watch the Ethereum price continue to lose ground versus its major rivals like Bitcoin.

Despite a surprise softening of US consumer price inflation that gives the Fed room to ease rates later in 2025, per data released on Wednesday, has failed to substantially lift the Ethereum price, which continues to languish well below $2,000.

That’s despite a solid recovery from lows of other major cryptos like Bitcoin, XRP and BNB. Indeed, the ETH/BTC ration just hit its lowest level in nearly 5 years under 0.023.

Ethereum’s accelerating downwards spiral versus Bitcoin is of major concern to its investors. At this rate, a retest of its 2019 lows around 0.016 could come imminently.

And with the Ethereum price chart sending strong bearish signals, more downside is very likely.

Here’s Where the Ethereum Price is Headed Next

The Ethereum price has seen a break below, then rejection of the key long-term $2,140 resistance level in recent days.

That sends a strong bearish signal that the 2024- early 2024 $2,000-$4,000 range is a thing of the past, and that Ethereum is likely to find a new range at lower levels.

Bears will be eyeing a retest of the next major support zone around $1,500.

A retest of these levels seems very likely in the context of an uncertain macro backdrop.

Yes, softening US inflation gives the Fed more room to signal a slightly more dovish stance in 2025.

But the markets main concern will remain growing US recession risk as D.O.G.E austerity and Trump trade war uncertainty start to take their toll economic growth.

If recession signals keep piling up in the coming weeks, and the market isn’t sufficiently satisfied that the Fed will be there to “save the day”, risk appetite is likely to continue to deteriorate.

And while Bitcoin could hold up well thanks to strengthening narratives around it as a safe-haven, store of wealth asset, which have been emboldened since the Trump administration announced the creation of a strategic Bitcoin reserve, Ethereum is unlikely to receive much of a bid.

Fundamentals thus suggest a retest of $1,500 is looking very likely.

Buy the Ethereum Dip?

So if the Ethereum price is destined to collapse to lower levels, would this be a good time for investors to buy the dip.

Yes, for investors willing to hold through significant near-term turbulence, buying any ETH dip would likely be a good move.

Macro uncertainties will not last forever. And, at some point, US financial conditions are likely to to substantially ease, meaning a surge of liquidity in the market.

Prior periods of strong Ethereum price performance have come at times of increased/increasing liquidity from the Fed.

So a strong rebound is to be expected as the Fed juices the market. Meanwhile, over the longer term, tailwinds from the Trump administration’s pro-crypto policy stance should also aid Ethereum.

The Trump administration is full of ETH HODLers. And regulatory clarity will give the Ethereum ecosystem a lot of room to grow over the coming years.

Traders must also remember that Ethereum remains the dominant DeFi chain, and the most trusted smart contract blockchain in crypto, hence its backing from BlackRock.

As ugly as things look right now, and as much FUD as there is in the market, Ethereum’s long-term outlook remains strong.

Its biggest problem into the future is likely to remain a deteriorating market share as nimbler rivals attract new users at a faster rather than Ethereum does.

That said, Ethereum is still far and away the best candidate for major institutions looking to take part in DeFi, thanks to its status as the most trusted and decentralized of the smart contract blockchains.

Accumulating ETH as it approaches $1,500 with a view to hold for at least a few years could be a great strategy.

Investors should not rule out the possibility that ETH reaches $10,000 by the end of Trump’s four year term.

The post Ethereum Price Set to Dump to $1,500 Next – Buy the Dip? appeared first on Cryptonews.

News – Read More