A crypto whale recently lost $306.85 million after he exhausted his bets on Ethereum and got liquidated. The trader had been using 50x leverage to put all of his bets on ETH, hoping the price would appreciate, but the market didn’t go his way.

According to Lookonchain’s report on X, the whale first began trading the asset on March 10, 2025. He sold 947 ETH units for $1.95M in USDC and used it to long ETH on Hyperliquid. He kept stacking up the bets until he made 25,095 ETH, which is approximately 53.7 million dollars.

Throughout the following two days, the whale kept adding more ETH, eventually pushing his position to 73,076 ETH worth $138.75 million.

This morning, the trader moved all his BTC trades to ETH, further increasing his position to 140,458 ETH ($269.8M). His entry price was $1,900.28, and his liquidation level was set to $1,805. At one point, the trader was up $3.65M, but then things started turning bad.

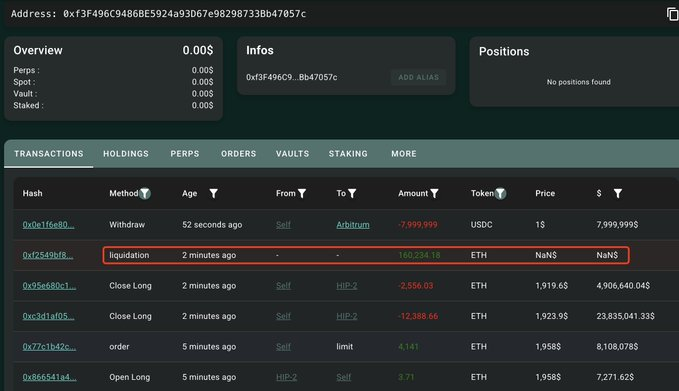

ETH’s price dropped and fell below the whale’s liquidation price. Within minutes, his entire position was wiped out. “This whale just got liquidated for 160,234 ETH ($306.85M)!” Lookonchain confirmed.

This is one of the biggest single liquidations in crypto history. Trading with 50x leverage is risky. Even small price drops can wipe out an entire position. This whale’s high-stakes gamble failed, and now the whole crypto space is talking about it.

One user on X said, “High leverage, high consequences. Whale’s $300M+ ETH position just got wiped at $1,877. This is why trading with leverage is basically gambling – one wrong move and it’s game over. Let this be a lesson in risk management.”

Some traders even started wondering if the whale had inside information. Whether this is a result of bad luck, poor strategy, or something else, no one would know. But one thing is certain, crypto can make or break fortunes in a blink.

Also Read: Polymarket Sees 41% Chances For US Recession in 2025

The Crypto Times – Read More