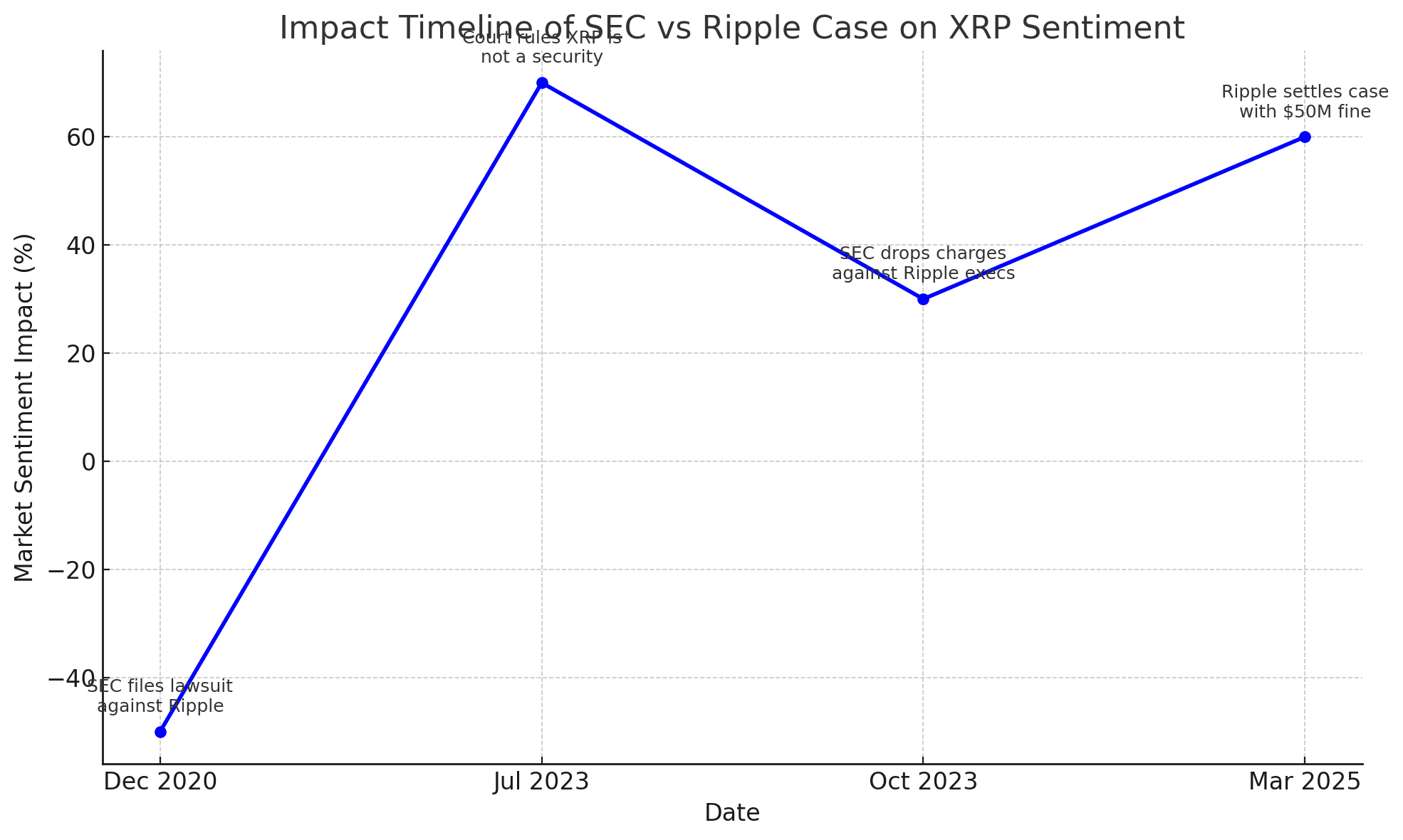

As per the source, Ripple Labs has reached a settlement with the U.S. Securities and Exchange Commission (SEC), concluding a protracted legal battle that has cast a shadow over XRP, the digital asset associated with Ripple. This resolution has ignited optimism about the potential approval of an XRP-based Exchange-Traded Fund (ETF), with major asset managers like BlackRock and Fidelity anticipated to enter the fray.

Ripple’s Legal Victory: A Turning Point for XRP

The legal dispute between Ripple and the SEC centered on allegations that Ripple conducted an unregistered securities offering by selling XRP. After years of litigation, Ripple agreed to settle the lawsuit by paying a reduced fine of $50 million, significantly lower than the initially imposed $125 million. This settlement, pending final approvals, marks a pivotal moment, signaling a more lenient regulatory stance toward the cryptocurrency sector. Notably, Ripple did not admit any wrongdoing as part of the agreement.

The Ripple Effect: Anticipation of an XRP ETF

The resolution of Ripple’s legal challenges has led industry experts to speculate about the imminent approval of an XRP-based ETF. Nate Geraci, president of the ETF Store, expressed confidence that it’s “obvious” that a spot XRP ETF approval is simply a matter of time. He anticipates that leading asset managers like BlackRock and Fidelity will be involved, given XRP’s status as the third-largest non-stablecoin cryptocurrency by market capitalization.

Supporting this sentiment, users on the crypto betting platform Polymarket have assigned an 86% probability to the approval of an XRP ETF by the end of 2025, reflecting growing market confidence in such a development.

Market Reaction: XRP’s Price Surge

Following the announcement of the settlement, XRP’s price experienced a notable increase, rising over 8% to approximately $2.50. This surge underscores investor optimism about XRP’s future prospects in a more favorable regulatory environment.

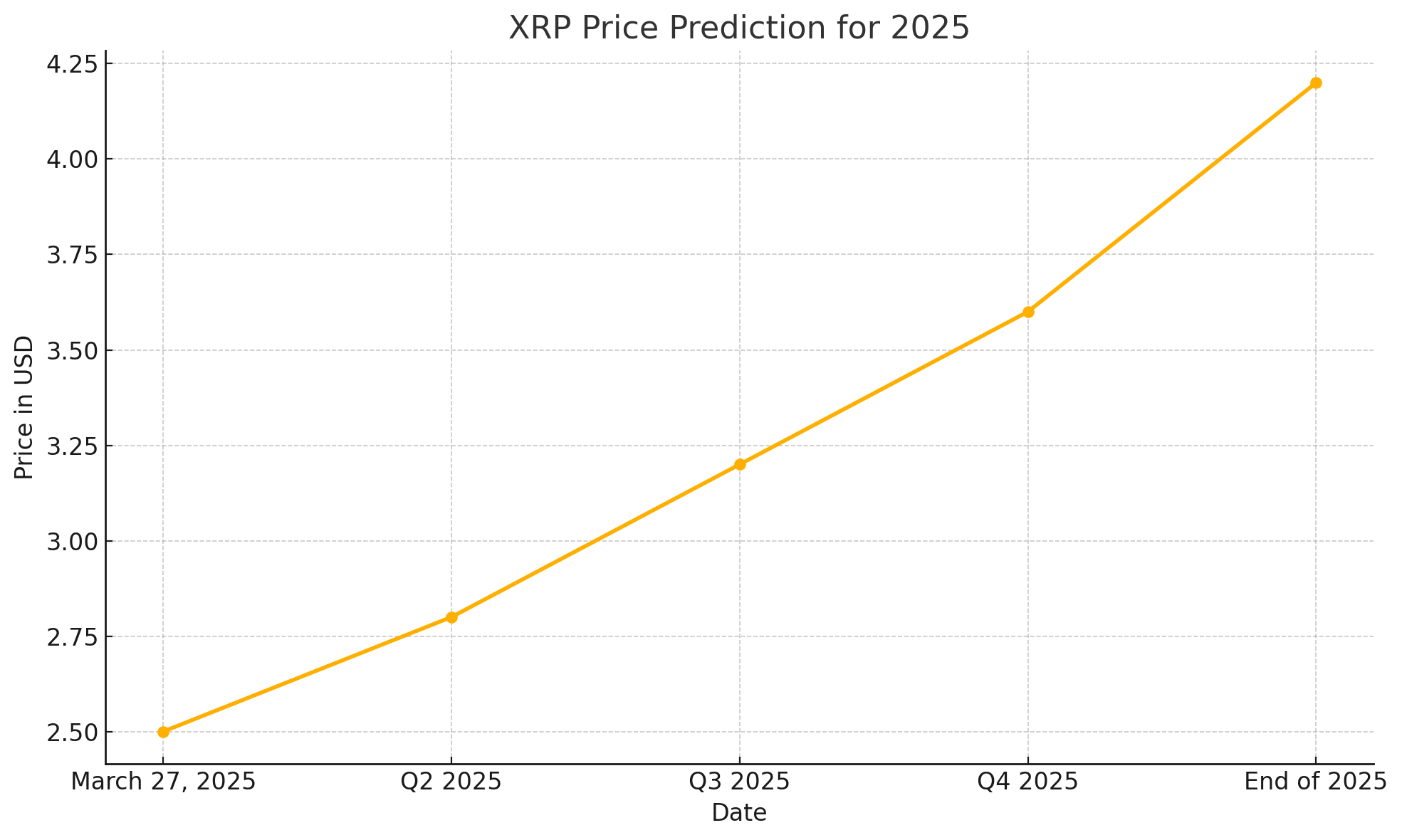

Price Predictions: What Lies Ahead for XRP?

Analysts have offered varied predictions for XRP’s price trajectory post-settlement. Some foresee a potential doubling of XRP’s value by the end of 2025, citing the removal of legal uncertainties and the anticipated approval of an ETF as key drivers. Others suggest that if XRP replicates its previous market reactions to positive legal outcomes, it could experience a significant surge, potentially reaching new all-time highs.

XRP Price Prediction Table (2025)

| Date | Price Prediction (USD) | Sentiment |

|---|---|---|

| March 27, 2025 | $2.50 | Bullish |

| Q2 2025 | $2.80 | Bullish |

| Q3 2025 | $3.20 | Very Bullish |

| Q4 2025 | $3.60 | Very Bullish |

| End of 2025 | $4.20 | Extremely Bullish |

These projections reflect market confidence fueled by regulatory clarity and anticipated institutional participation in an XRP ETF.

Conclusion: A New Chapter for XRP

The settlement between Ripple and the SEC marks the beginning of a new chapter for XRP. With legal uncertainties largely resolved, the path appears clearer for the approval of an XRP ETF, potentially involving major institutional players like BlackRock and Fidelity. This development could significantly enhance XRP’s market presence and adoption, offering investors new avenues for engagement. However, as with all investments, potential investors should conduct thorough research and consider market volatility before making decisions.

FAQs

What is an Exchange-Traded Fund (ETF)?

An ETF is a type of investment fund that is traded on stock exchanges, much like stocks. It holds assets such as stocks, commodities, or bonds and generally operates with an arbitrage mechanism designed to keep it trading close to its net asset value, though deviations can occasionally occur.

Why is the approval of an XRP ETF significant?

The approval of an XRP ETF would provide investors with a regulated and accessible way to gain exposure to XRP without directly purchasing the cryptocurrency. It could also lead to increased liquidity and broader adoption of XRP in the financial markets.

How does the Ripple-SEC settlement impact XRP investors?

The settlement reduces regulatory uncertainty surrounding XRP, potentially increasing investor confidence and positively impacting its price. It also paves the way for the development of financial products like ETFs that could further enhance XRP’s market presence.

Glossary of Key Terms

XRP: A digital asset used primarily for facilitating transactions on Ripple Labs’ payment platform.

Exchange-Traded Fund (ETF): An investment fund traded on stock exchanges, holding assets like stocks, commodities, or bonds.

Securities and Exchange Commission (SEC): A U.S. government agency responsible for enforcing federal securities laws and regulating the securities industry.

Settlement: An agreement reached between parties in a lawsuit, resolving the dispute without further litigation.

Market Capitalization: The total market value of a cryptocurrency’s circulating supply, calculated by multiplying the current price by the total supply.

Sources

Read More: Following Ripple SEC Resolution BlackRock Eyes XRP ETF“>Following Ripple SEC Resolution BlackRock Eyes XRP ETF

The Bit Journal – Read More