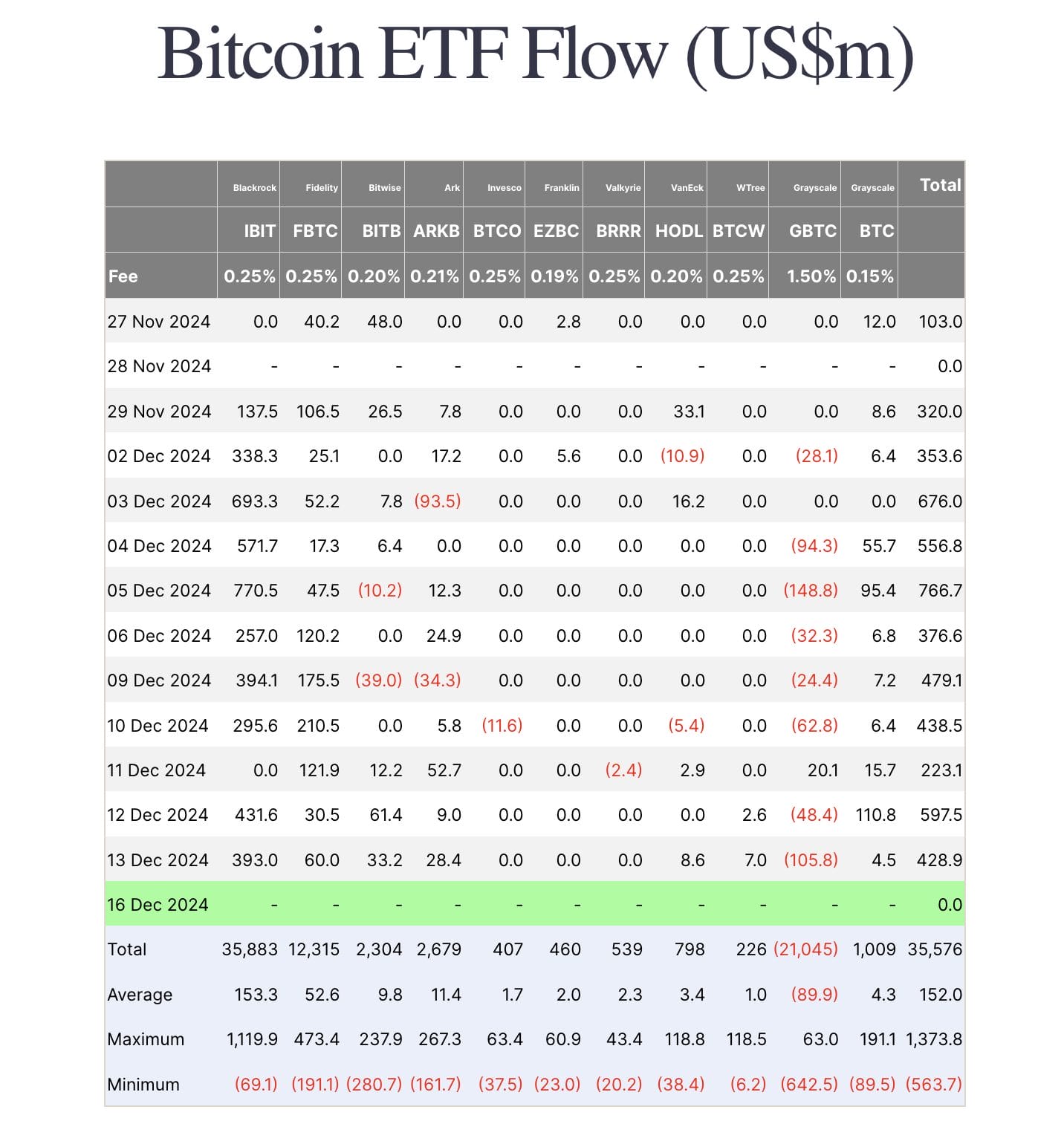

The Grayscale Bitcoin Trust (GBTC) has recorded $21 billion in outflows since its launch on January 11, according to the data posted by Farside. Currently, it is the only U.S. spot Bitcoin exchange-traded fund (ETF) with a negative net investment flow.

Despite GBTC’s challenges, the overall spot Bitcoin ETF market has flourished, attracting more than $35.5 billion in investments in under a year.

This stark contrast highlights the growing demand for Bitcoin exposure through other regulated ETFs, even as GBTC struggles to keep pace.

GBTC Outflows Are Larger Than Other ETFs’ Inflows

According to Farside data, Grayscale Bitcoin Trust has suffered daily outflows averaging $89.9 million over the past 11 months. It amounts to $21.045 billion in losses since its launch in January 2024.

Meanwhile, nine other spot Bitcoin ETFs approved in the U.S. have secured $20.737 billion in positive net investments.

Fidelity Wise Origin Bitcoin Fund, ARK 21Shares Bitcoin ETF, and Invesco Galaxy Bitcoin ETF have contributed to this growth, alongside offerings from Franklin, Valkyrie, VanEck, WisdomTree, and even Grayscale’s Bitcoin Mini Trust ETF.

Despite these successes, the combined inflows of these funds still fall short of offsetting the massive outflows from GBTC.

BlackRock’s iShares Bitcoin Trust (IBIT) is a key player reshaping the market. This fund has emerged as a dominant force. It attracted an impressive $35.883 billion in inflows, with an average daily intake of $153.3 million since its launch.

The overall investor confidence in BlackRock’s offering has pushed the total spot Bitcoin ETF market to exceed $35.5 billion in investments within a year.

Grayscale’s GBTC ETF current struggles are particularly striking, given its pivotal role in pioneering the Bitcoin ETFs.

The Securities and Exchange Commission (SEC) approved the launch of spot Bitcoin ETFs on January 11, marking a major regulatory shift after years of rejecting similar applications. The change was primarily compelled by a court ruling in favor of Grayscale in 2023, a victory many thought would solidify its position in the market.

However, the fund’s rapid outflows suggest otherwise. Investor confidence appears to have shifted elsewhere.

The challenges extend beyond Bitcoin. Grayscale’s Ethereum Trust ETF (ETHE) now mirrors the struggles of its Bitcoin counterpart. Farside data details that the ETHE fund has recorded losses exceeding $3.5 billion since its launch in July 2024.

This contrasts sharply with the positive inflows seen across other spot Ether ETFs, where BlackRock’s iShares Ethereum Trust ETF (ETHA) and Fidelity Ethereum Fund (FETH) lead the market with $3.2 billion and $1.4 billion in investments, respectively.

Grayscale Pursues Multi-Crypto Fund Approval Amidst Bitcoin ETF Outflows

As Grayscale’s Bitcoin Trust and Ethereum funds continue to face major outflows, the crypto asset manager is exploring new opportunities, which include a reported focus on a broader, multi-crypto offering.

On October 14, the New York Stock Exchange (NYSE) filed a request on behalf of Grayscale to convert its Digital Large Cap Fund into an exchange-traded fund (ETF). This over-the-counter trading fund currently holds a diversified portfolio. It includes major cryptocurrencies like Bitcoin, Ethereum, Solana, Ripple, and Avalanche.

This move marks a significant step for Grayscale. The company already manages several funds:

- GBTC

- Bitcoin Mini Trust (BTC)

- Ethereum Trust (ETHE)

- Ethereum Mini Trust (ETH)

By launching a multi-token ETF, Grayscale aims to cater to the growing investor demand for diversified crypto exposure. It offers a broader range of assets in a single fund.

However, its success will largely depend on whether it can restore trust among investors disillusioned by the poor performance of its previous funds.

The post Grayscale Faces $21 Billion Exodus as Spot Bitcoin ETFs Flourish appeared first on Cryptonews.

News – Read More