- A whale’s 50x leveraged ETH trade exposed risk flaws in Hyperliquid, sparking debate on leverage limits in decentralized exchanges.

- Lowering leverage helps but isn’t foolproof—traders can still bypass limits without KYC, raising concerns about sustainable DEX risk control.

- Adopting dynamic risk limits and improved liquidation mechanics may help, but each step makes DEXs more like centralized exchanges.

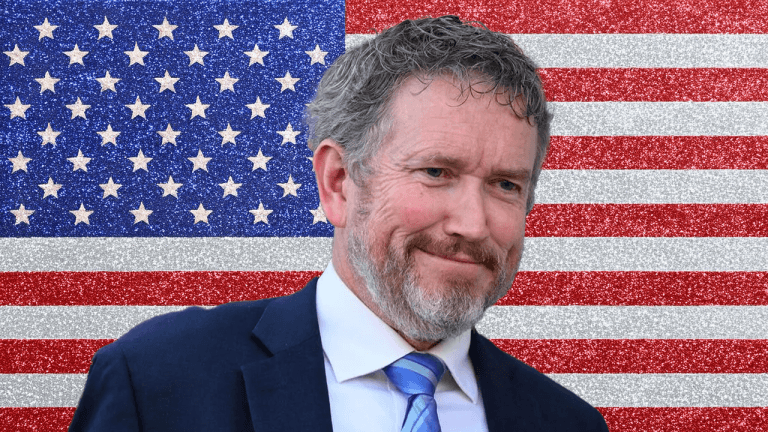

A massive Ethereum liquidation on Hyperliquid has reignited discussions about leverage and risk management in decentralized exchanges (DEXs). Ben Zhou, CEO of Bybit, shared insights on the incident, highlighting the challenges DEXs face in balancing leverage offerings and risk controls.

A whale reportedly opened a $300 million long position on ETH with just $15 million in margin using 50x leverage. Instead of exiting via a market order, which would have resulted in heavy slippage, the trader seemingly manipulated their position.

By strategically withdrawing floating P&L, they pushed their liquidation price higher, allowing Hyperliquid’s liquidation engine to take over the position. Consequently, the platform incurred losses, shedding light on vulnerabilities in DEX risk management.

Following the incident, Hyperliquid reduced leverage limits, with Bitcoin leverage dropping to 40x and Ethereum to 25x. While this move curbs immediate risks, it raises concerns about platform competitiveness. Traders favor high leverage, and lowering limits could drive them to alternative platforms.

Besides, reducing leverage alone does not eliminate abuse. Traders can create multiple accounts, bypassing restrictions and maintaining high exposure. Without Know Your Customer (KYC) checks, preventing such activity remains a challenge for DEXs.

A long-term solution requires DEXs to adopt advanced risk management mechanisms. Zhou suggested Dynamic Risk Limits replying to a comment from a user by the name CryptoData, which gradually reduces leverage as position sizes grow. This approach mirrors centralized exchange (CEX) risk controls, where large positions see leverage decline dynamically.

However, without KYC enforcement, traders can circumvent these limits. This raises a fundamental question: Can DEXs sustain high leverage without centralization? Implementing Open Interest (OI) caps, market surveillance, and improved liquidation mechanics could help. But each step taken toward risk control brings DEXs closer to CEX-like frameworks.

Cryptonewsland – Your Daily Crypto News – Read More