|

Getting your Trinity Audio player ready… |

SEC drops Ripple lawsuit, ending a multi-year legal battle

Last week, the U.S. Securities and Exchange Commission (SEC) has officially dropped its lawsuit against Ripple Labs. This marks the end of a legal battle that began on December 22, 2020, when the SEC alleged that Ripple and its executives, including CEO Brad Garlinghouse, had raised over $1.3 billion through an unregistered securities offering via XRP token sales.

After years of courtroom back-and-forth, a judge eventually ruled that Ripple’s institutional XRP sales violated securities laws and slapped the company with a $125 million penalty. However, the court also ruled that sales to the general public on exchanges were not securities transactions. The SEC initially filed an appeal, hoping to overturn that part of the ruling and label retail sales as securities, too, but has now withdrawn that appeal. On March 19, Garlinghouse announced that the SEC had dropped the case entirely.

This move signals that the SEC has accepted the court’s decision unless the SEC were to file new charges against Ripple Labs.

From Ripple’s perspective, this is probably a huge relief. But for many in the broader crypto community, it’s also a big win. The question of whether various coins and tokens are securities, commodities, or some entirely new class of asset has been hanging over the industry for years with no clear answer.

The current administration has taken a softer stance, frequently stating that many tokens and memecoins do not fall under the SEC’s jurisdiction. The Ripple ruling could now serve as a precedent that shapes how courts and regulators approach other tokens in the future. Whether it holds up as a guiding standard or ends up being a one-off remains to be seen, but for now, it’s a win that the industry is celebrating.

SEC announces crypto roundtable to discuss token classification

Also out of the SEC last week, the SEC’s crypto task force announced an upcoming roundtable titled “How We Got Here and How We Get Out – Defining Security Status,” scheduled for March 21. The event was held in-person and streamed online.

Hester Peirce, head of the SEC’s crypto task force, says the event will be “an open and frank discussion about defining the security status of crypto assets.” The guest list includes lawyers from prominent law firms and representatives from companies operating in the cryptocurrency space.

Based on the speaker lineup, I’d expect the focus to lean heavily toward the legal mechanics of how the SEC should treat digital assets, both from an enforcement and compliance perspective. The panel will eventually open up to a town hall-style Q&A, allowing attendees to ask direct questions.

The fact that this roundtable is even happening signals that the SEC is (at least publicly) interested in hearing from people closer to the ground floor of crypto. That’s encouraging. But two things still stick out.

First, if the SEC now claims that most tokens and coins aren’t securities and don’t fall under their purview, then why are they the ones hosting the conversation? Especially given how hard they’ve tried to explicitly say they don’t have jurisdiction over many coins in tokens under the current administration.

Second, events like these often feel like policy theater—well-produced discussions that give the illusion of collaboration without resulting in real change. A few months from now, we’ll know whether this was a sincere step toward updated policy or just more of the same.

Still, it’s worth tuning in to see where the discussion leads and whether any concrete action items emerge.

Coinbase and EY Survey: Institutions plan to buy more crypto

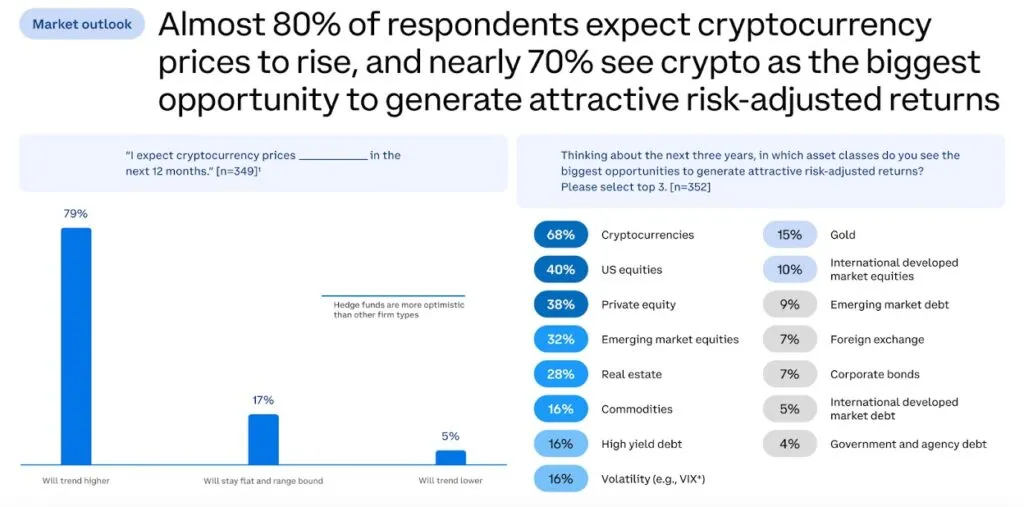

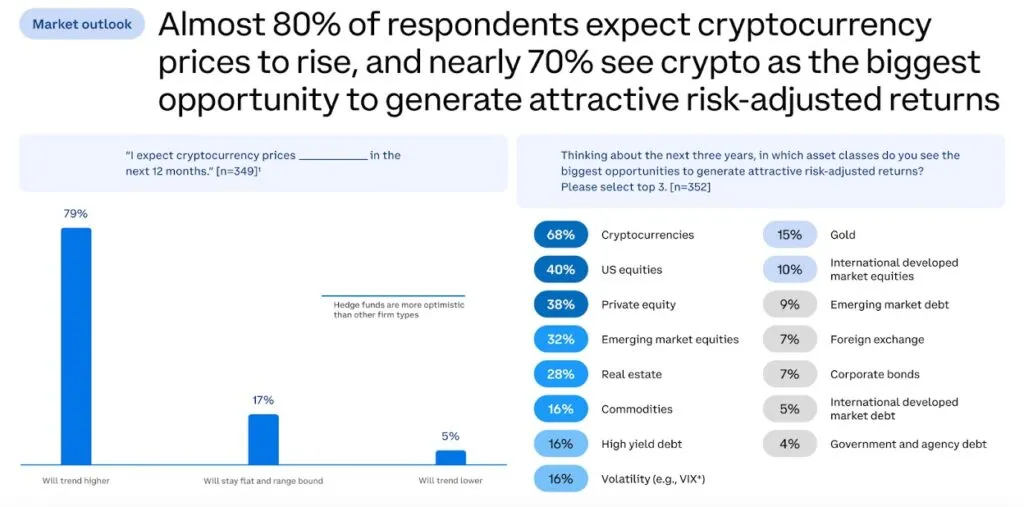

Last week, Coinbase (NASDAQ: COIN) and EY released a joint report titled “Increasing Allocations in a Maturing Market: 2025 Institutional Investor Digital Assets Survey.” Overall, the findings were optimistic…maybe even overly optimistic. The survey polled decision-makers at 352 firms worldwide and revealed that 83% of institutional investors plan to increase their crypto holdings in 2025.

What’s more interesting than the headline stat is how they plan to do it. About 60% said they prefer gaining exposure through registered investment vehicles like ETFs and exchange-traded products (ETPs) instead of directly buying spot crypto. That matters. While ETFs expose the underlying asset, they don’t offer the same experience—or risks—as holding the asset. For example, these vehicles are typically custodial and don’t require investors to manage wallets, private keys or engage in on-chain activity.

Another key takeaway is that about 80% of respondents predicted that crypto prices will trend upward over the next year, citing increased utility and expected regulatory clarity as key drivers. Regulatory clarity, in particular, was named by 57% of respondents as the top catalyst for market growth.

There’s also rising interest in stablecoins, with 84% of institutional respondents either already using or seriously considering using them. The respondents say that the main draw of stablecoins is their transactional convenience and the ability to simplify foreign exchange processes.

However, it’s important to note that the survey was conducted between January 13–24, 2025—when BTC was above $100,000. Since then, prices have dropped significantly. That drop happened even amid rising regulatory clarity and efforts by governments to support the crypto space, showing that even optimism from institutions doesn’t guarantee market stability.

It’s also worth remembering that institutional investors don’t approach the industry like retail investors or blockchain enthusiasts; this is a group of people whose job is to profit from trading. Which often causes their timelines to be shorter, their positions to be larger, and their exits to be sharp and decisive. Sometimes, these moves can give the entire market a boost, but on the flip side, when these institutional investors are looking for their exit, it can drag the market down and bring retail positions underwater.

Watch: Onboarding enterprises onto BSV blockchain via AWS

CoinGeek – Read More