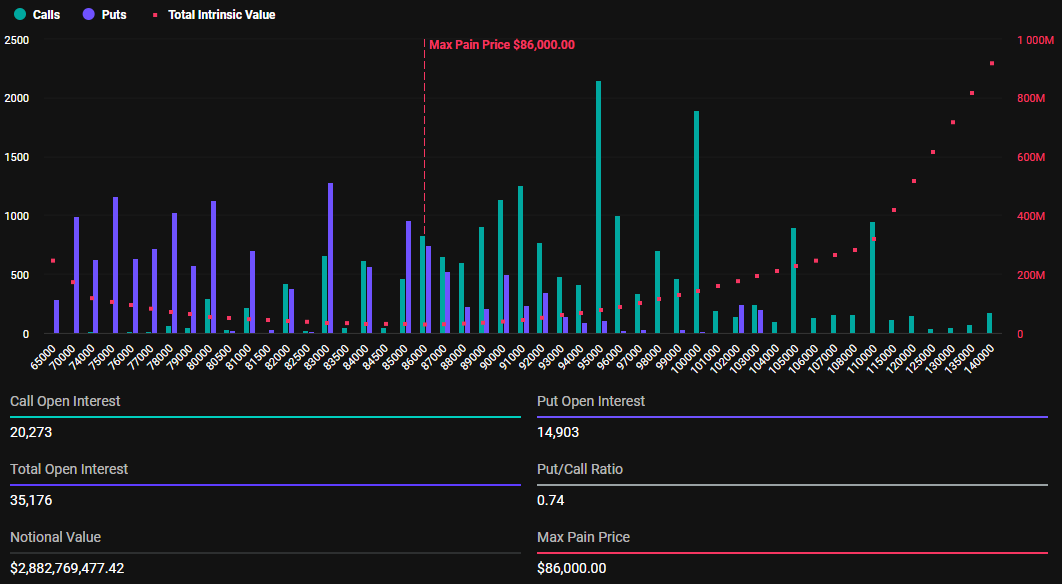

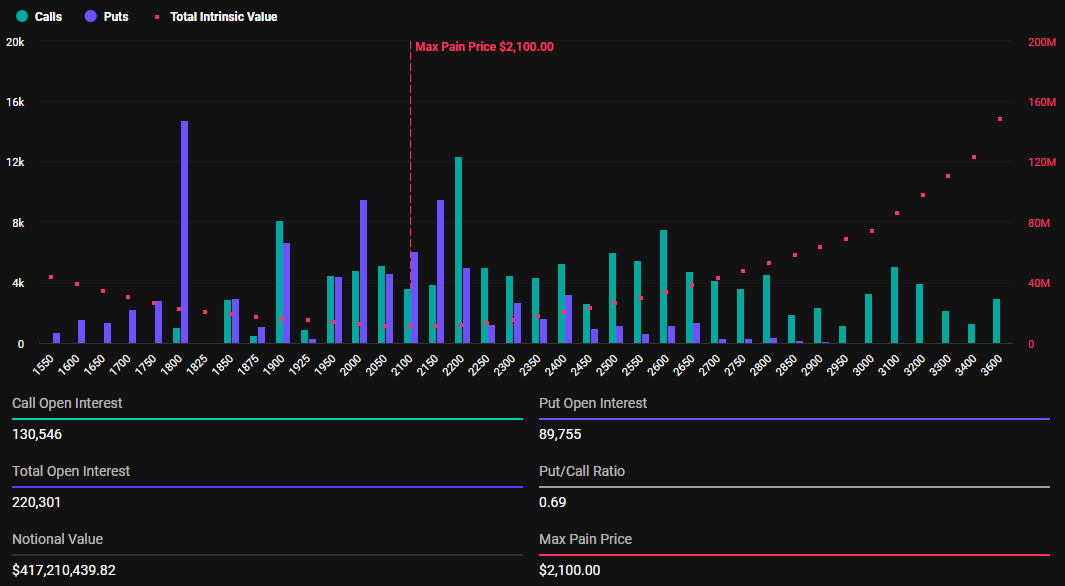

The cryptocurrency market is bracing for significant price movements as a staggering $3.29 billion worth of Bitcoin and Ethereum options are set to expire today. According to market data, $2.88 billion comes from Bitcoin options, while Ethereum options account for $417 million. This expiration could trigger substantial volatility, impacting short-term price action and investor sentiment.

Bitcoin and Ethereum Investors Prepare for Market Swings

Data from Deribit indicates that 35,176 Bitcoin options will expire today, compared to 29,005 BTC contracts that expired last week. The put/call ratio stands at 0.74, suggesting a bullish inclination despite Bitcoin’s recent descent from the $90,000 mark. The maximum pain point—the price level at which the most options expire worthless—is set at $86,000.

Meanwhile, 220,301 Ethereum options are also expiring, slightly down from last week’s 223,395 contracts. The put/call ratio is 0.69, with a maximum pain point of $2,100. These figures suggest Ethereum may also experience price fluctuations in the short term.

What’s Next for Crypto Investors?

As options expire, Bitcoin and Ethereum prices are expected to gravitate towards their respective maximum pain points. The “Max Pain” theory suggests that market forces often push asset prices towards levels where the highest number of contracts expire worthless. This dynamic could lead to temporary price suppression before a potential rebound.

Deribit analysts are closely monitoring whether the max pain level continues to decline or if a reversal is imminent. Once today’s contract expirations are settled, market pressure on BTC and ETH may ease. However, the sheer scale of these expiring options could fuel heightened volatility in the crypto space.

Market Sentiment and Broader Economic Factors

Despite positive U.S. inflation data earlier this week, analysts at Greeks.live note that short-term sentiment remains bearish. Some traders are watching key support levels, with certain market participants predicting a possible dip to $60,000 for Bitcoin.

Moreover, geopolitical and macroeconomic factors are influencing investor sentiment. Analysts highlight that concerns over U.S. tariffs and inflation may outweigh geopolitical developments like the Ukraine peace negotiations. Recent surveys, including one from JPMorgan, indicate that 51% of traders view inflation and tariffs as the most significant market-moving factors of the year.

Renowned analyst Tony Stewart has also pointed out notable shifts in Bitcoin derivatives trading patterns. He notes that after Bitcoin dropped to $76,500 on March 11, buyers took profits, leading to intensified trading activity above $90,000 but with less sustained momentum.

As the crypto market navigates these fluctuations, investors and traders should remain vigilant and monitor key price levels. The evolving economic landscape and derivative market trends will continue to shape Bitcoin and Ethereum’s trajectory in the coming weeks.

- https://twitter.com/Thebitjournal_

- https://www.linkedin.com/company/the-bit-journal/

- https://t.me/thebitjournal

Follow us on Twitter and LinkedIn and join our Telegram channel to get instant updates on breaking news!

Read More: Major Volatility Expected as Bitcoin and Ethereum Options Expire“>Major Volatility Expected as Bitcoin and Ethereum Options Expire

The Bit Journal – Read More