As one of the largest issuers of tokenized real-world assets (RWAs), with a market cap exceeding $600 million, Ondo is no stranger to bringing traditional finance onto blockchain rails. The firm is already the third-largest tokenized U.S. Treasury issuer, according to data from rwa.xyz.

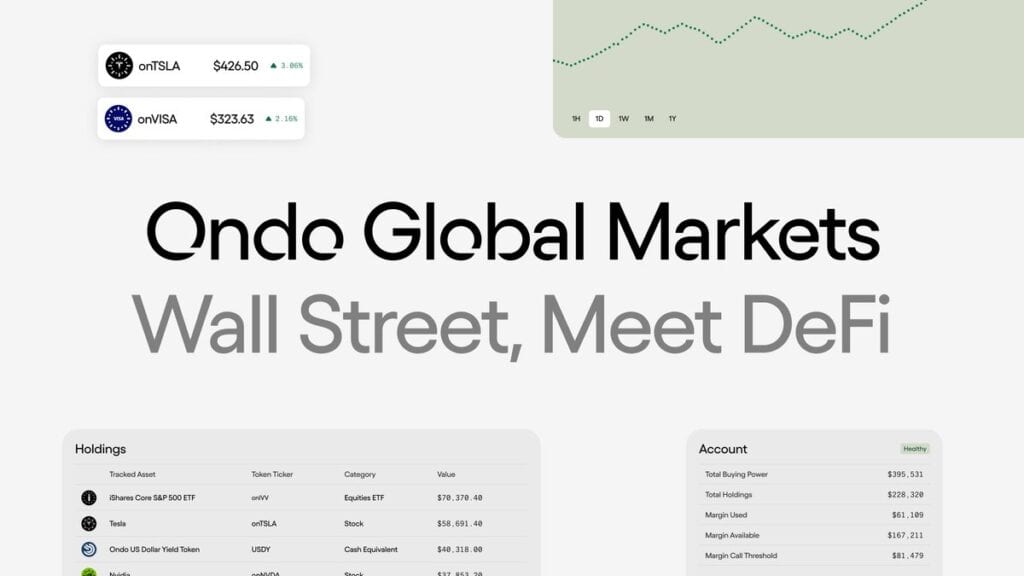

The launch of Ondo GM underscores the company’s ambition to disrupt what it describes as an inefficient and exclusionary investment ecosystem—one plagued by high fees, limited access, and platform silos that prevent millions from participating in global financial markets. By tokenizing conventional financial instruments, Ondo aims to create a system that is more accessible, transparent, and efficient.

Tokenization with Compliance Controls

While Ondo has not yet disclosed which specific stocks, bonds, or ETFs will be available on the platform, it has stated that Ondo GM will function similarly to stablecoin liquidity models. This means users will be able to mint freely transferable tokens linked to traditional financial assets, but with built-in compliance controls determining who can access, buy, and sell these tokens.

“We are leveraging blockchain to bring institutional-grade financial markets onchain, making them more efficient and widely accessible,” Ondo stated in an announcement on X.

DeFi is coming to Wall Street, Source: X

The move signals an accelerating trend of blockchain-based financial infrastructure replacing legacy systems, as firms like Ondo seek to remove friction from capital markets and create a more open, permissioned yet fluid investment landscape based on tokenization.

Ondo’s latest initiative aligns with the broader industry shift toward blockchain-enabled finance, where tokenization is increasingly seen as a solution to outdated financial structures. With institutional and retail demand for tokenized assets growing, Ondo GM could be a significant step toward mainstream adoption.

Ondo Finance Brings $185M Tokenized Treasuries to XRP Ledger, Strengthening Institutional Adoption

The tokenization of real-world assets (RWA) is accelerating, and Ondo Finance is doubling down on the trend. Last month the firm announced it is bringing its $185 million U.S. Treasury-backed token, OUSG, to Ripple’s XRP Ledger (XRPL)—a move that could significantly expand institutional access to blockchain-based finance.

A Strategic Integration: OUSG on XRPL

The Ondo Short-Term US Government Treasuries (OUSG) token is backed by BlackRock’s USD Institutional Digital Liquidity Fund (BUIDL) and allows qualified investors to mint and redeem tokens nearly instantly using Ripple’s RLUSD stablecoin. The XRPL deployment is set to go live within six months, according to Ondo Finance.

To kickstart liquidity, both Ripple and Ondo Finance have provided seed investments, though the specific amounts remain undisclosed.

Why This Matters: The Growing RWA Market

The tokenization of RWAs—including bonds, credit instruments, and investment funds—is reshaping the financial landscape. By representing traditional assets onchain, tokenization enhances liquidity, settlement speed, and efficiency compared to conventional markets.

Tokenized U.S. Treasury products have been leading the charge, with the sector quadrupling in size over the past year, now worth approximately $3.5 billion, per rwa.xyz.

Markus Infanger, Senior Vice President of RippleX, emphasized the disruptive potential of blockchain-based treasuries:

“The 24/7 intraday settlement enabled by tokenized assets like OUSG represents a transformative shift in capital flow management, freeing transactions from traditional market hours and slow settlement processes.”

He highlighted the benefits of low-risk, high-quality liquidity solutions, which enhance accessibility for institutional investors and bring greater stability to blockchain finance.

XRPL: The Institutional Blockchain for RWA Tokenization

For Ripple and XRP enthusiasts, this is a major win and good news. The XRP Ledger was designed from the ground up to support institutional finance, making it an ideal platform for RWA tokenization and decentralized finance (DeFi).

Key XRPL features include:

- Advanced compliance tools like Decentralized Identifiers (DIDs) and price oracles

- Upcoming innovations like Multi-Purpose Tokens (MPTs) and Permissioned Domains

- A track record of over a decade in cross-border payments, stablecoin issuance, and asset custody

These features position XRPL as a premier destination for tokenized U.S. Treasuries, making it a critical bridge between traditional finance and DeFi.

What’s Next? Institutional-Grade Finance on XRPL

By integrating OUSG with the XRPL, Ondo Finance is directly delivering institutional-grade assets to institutional investors, providing onchain access to high-quality yield products.

This partnership is more than just another RWA project—it’s a step toward revolutionizing institutional financial management. The XRPL is proving itself as a formidable player in the tokenization race, solidifying its role as a cornerstone for next-gen institutional finance.

As the tokenization of U.S. Treasuries and other RWAs accelerates, expect XRPL to become a key infrastructure for institutions navigating the blockchain economy.

Watch: XRP Price Analysis

Brave New Coin – Read More