Three influential PEPE whales executed the total purchase of 689.79 billion PEPE tokens within the market. Whale purchases of large PEPE amounts have produced market hype, which suggests the PEPE price might experience a price rally. Traders remain vigilant for price stability indicators while monitoring signs that point towards an upcoming token ascent after investing $4.3 million in the token.

Whale Purchases Show Confidence in PEPE Price Potential

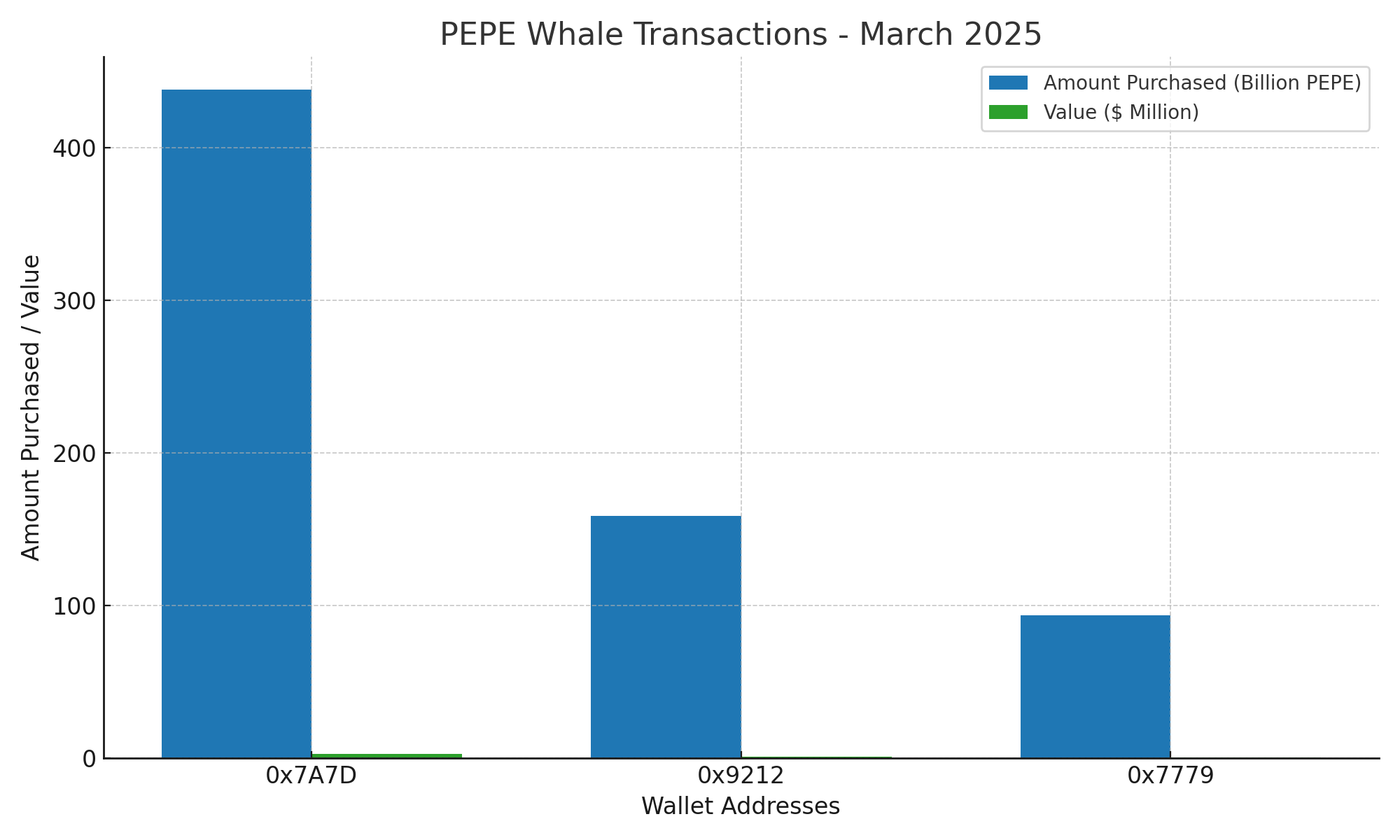

Through their substantial token acquisitions, PEPE’s future potential has gained strong backing from whale wallets. Whale wallets 0x7A7D and 0x9212 and 0x7779 bought 689.79 billion PEPE tokens from three separate transactions which totaled $4.3 million on March 13, 2025. Users conducted these transactions by utilizing TornadoCash as a privacy protocol for making anonymous transactions.

Wallet 0x7A7D performed the largest purchase by buying 437.7 billion PEPE tokens for $2.72 million worth of 1,413.4 WETH. Wallet 0x9212 conducted a purchase of 158.58 billion PEPE tokens for one million dollars while wallet 0x7779 purchased 93.51 billion tokens using $574,000. The giant purchase demonstrates PEPE’s promising prospects in the eyes of investors.

According to crypto analyst David Reed, the recent massive whale transactions demonstrate that big investors believe the PEPE price may experience an upcoming upward trend. Market sentiments rise, and prices experience upward movement because of purchases made with intense buying pressure.

Adding to the buying activity in the market caused a reduction of circulating supply that generated bullish momentum. Many traders predict PEPE value will continue to climb since additional investors keep purchasing the token.

Table: Recent PEPE Whale Transactions

| Wallet Address | Amount Purchased (Billion PEPE) | Value ($) | Date of Transaction |

| 0x7A7D | 437.7 | $2.72 million | March 13, 2025 |

| 0x9212 | 158.58 | $1 million | March 13, 2025 |

| 0x7779 | 93.51 | $574,000 | March 13, 2025 |

PEPE Price Shows Bullish Reversal Signs

PEPE Price Shows Bullish Reversal Signs

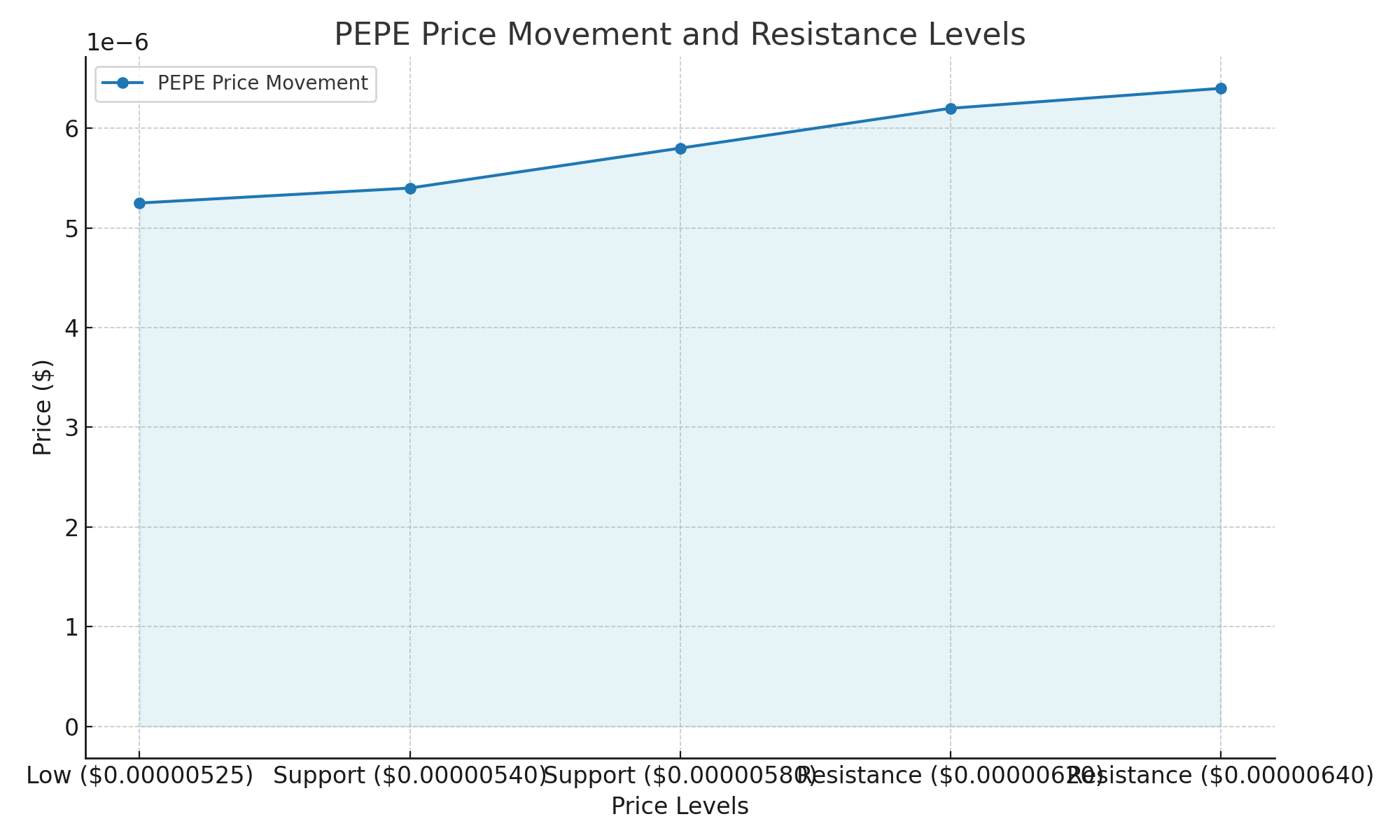

The daily PEPE price analysis through TD Sequential indicator indicates PEPE may be set for a market reversal. The TD Sequential indicator generated a buy signal thus indicating the memecoin might soon experience a bullish upward trend.

PEPE finished trading at $0.00000597 after showing a 4.74% growth. PEPE shows indications of potential reversal mainly because its price continues upward while it approaches its recent low of $0.00000525. The price point of $0.00000525 shows exhaustion behavior since such extremes usually lead to market price recovery.

According to Sophie Clark, an expert trader, the analysis of this purchase sign, along with PEPE price exhaustion at $0.00000525, strengthens price reversal predictions. If bulls gain dominance, the PEPE price could reach $0.00000620, while crossing $0.00000640 could produce further upward momentum.

Price consolidation between $0.00000540 and $0.00000580 might occur before PEPE moves to another area.

Low Volume Could Limit Price Action

Low Volume Could Limit Price Action

The low trading volume restricts PEPE price movements for PEPE. The recent whale activities brought positive expectations to the market yet PEPE’s total trading volume has maintained a low level since February 2025. The exchange recorded only 278 transactions during March 11, 2025 whereas it reached a previous high of 304 trades throughout the preceding 7-day span.

Market price growth seems restrained by current low activity levels because minimal trading volume reduces the chances for sustained upward movement. Price stabilization might occur due to reduced trading activity because PEPE could stay within the price bracket of $0.00000540 and $0.00000580.

An increase in trading volume could lead the entrance of whale investors causing PEPE to surpass $0.0000060 and potentially trigger additional price growth. The price is likely to stay stable at current levels or drop to $0.00000495 when trading volume shows no sign of improvement.

PEPE’s Path Forward: Consolidation or Reversal?

People on the market need to watch for whale activities since this period may establish crucial price conditions for PEPE. Market momentum from bullish support would trigger the memecoin to advance its price levels upward. The price reversal for PEPE faces failure if buying momentum weakens or the price drops underneath $0.00000525.

PEPE’s market performance will largely depend on the continued acquisition of tokens by whales together with traders demonstrating support for price recovery. High buying behavior indicates price increases whereas minimal market volume acts as a barrier to future price growth.

Conclusion

The market experienced a major shift when PEPE whales invested 689 billion tokens thus creating potential price growth conditions. кілька technical indicators point to PEPE entering an upward price trend within upcoming periods. The market price might face resistance due to minimal trading action despite indications that momentum could sustain itself.

The price direction of PEPE price during its short-term period mainly depends on major trading activity together with increased market movement. People need to exercise caution because market volatility together with its fast-moving dynamics remains present. Keep following The Bit Journal and keep an eye on PEPE price.

Frequently Asked Questions (FAQs)

-

What is the TD Sequential indicator?

TD Sequential represents a technical indicator which helps detect price trends and market reversal possibilities. The TD Sequential indicator functions as a technical analysis instrument for detecting market trends together with possible change points.

-

Large holder movements in PEPE transactions have what effect on the token’s market price?

Massive PEPE acquisitions conducted by whale investors lead to decreased supply values that consequently push the token price upward.

-

What is the significance of the buy signal on the daily chart?

A daily chart buy signal creates essential information that affects market direction. An buy signal on the TD Sequential indicator indicates that PEPE price might be starting a bullish reversal phase that might cause prices to grow.

-

The low PEPE trading volume persists currently due to what factors?

PEPE maintains low trading volume because market participants demonstrate minimal interest and there are few transaction activities. Nonetheless PEPE’s price may stay stagnant unless new market participants increase their investment activities.

Glossary of Key Terms

- Whale: defines someone who owns significant amounts of cryptocurrency and holds the power to impact market valuation.

- TD Sequential Indicator: functions as a technical indicator which detects price reversal possibilities in market trends.

- TornadoCash: functions as a blockchain privacy protocol which enables users to maintain transaction confidentiality through its anonymous system.

References:

Follow us on Twitter and LinkedIn and join our Telegram channel to be instantly informed about breaking news!

The Bit Journal – Read More