- Pi Network’s price has fallen nearly 45%, with traders fearing further losses due to negative market sentiment.

- The looming KYC deadline and technical indicators suggest Pi Network may face prolonged instability, hindering potential recovery.

Pi Network has been struggling with an ongoing price decline, leaving traders on high alert. The altcoin, once anticipated to break out, is now facing strong headwinds in the market. Despite some optimism about a potential rebound, many are preparing for further losses instead of gains as traders remain concerned about the 82.8 billion supply controlled by the Pi team, as CNF reported earlier.

Adding to the growing uncertainty is the looming deadline for KYC verification and Mainnet Migration. Investors failing to complete the process by March 14 could see a significant portion of their balance wiped out, with only the Pi mined within the last six months remaining accessible. This pressure is driving traders to reposition themselves, anticipating possible losses.

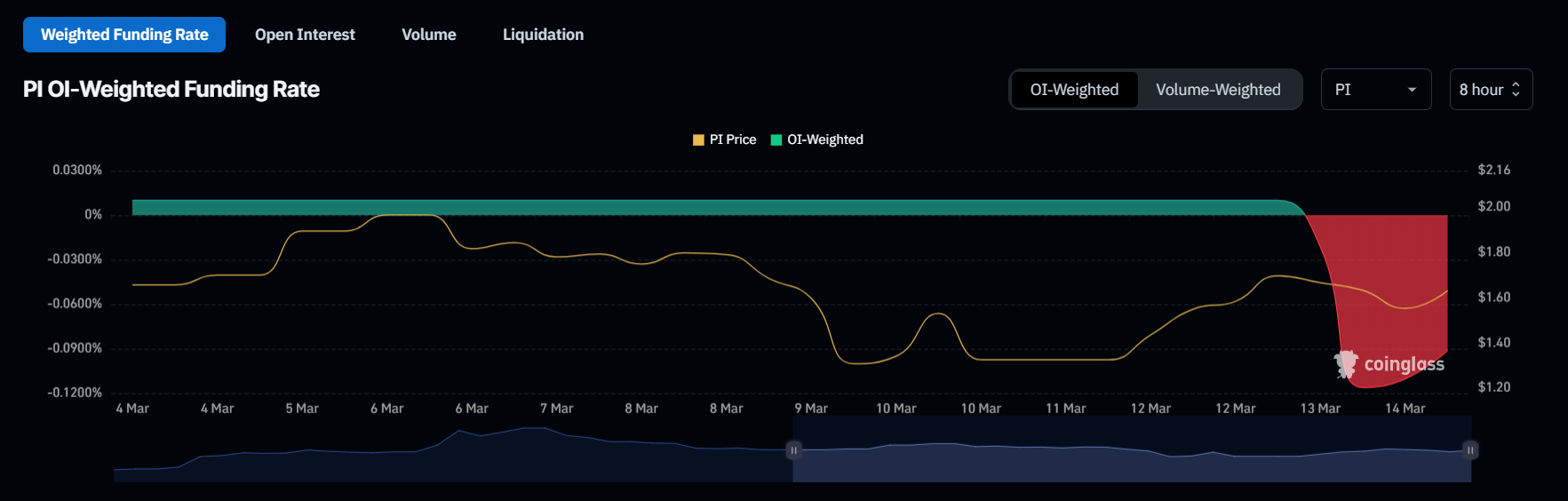

The bearish sentiment is reflected in the deeply negative funding rate in the Futures market, indicating that more traders are betting on price declines rather than gains. The overwhelming preference for short contracts over long positions suggests that many expect a price fall rather than a rally.

Technical Indicators Paint a Grim Picture for the Pi Network

Pi Network has lost nearly 45% of its value since peaking at almost $3 in February, now trading below $2. The altcoin remains a shadow of its former self, far from its $100 price point recorded during its IoU phase in November 2023. The steep decline raises doubts about whether the Pi Network can ever reclaim its past highs.

A key concern is the Moving Average Convergence Divergence (MACD) indicator, which is showing signs of a bearish crossover, according to TradingView. This is often seen as a strong signal for further price declines, reinforcing the caution among investors.

The broader market momentum does not offer much hope either. With Pi Network struggling to sustain any meaningful upward push, short-term traders are likely to capitalize on even the smallest price bumps, further pressuring the altcoin. The combination of technical weakness and skeptical investors has left Pi Network in a vulnerable position.

From $100 to $2—What Went Wrong?

Pi Network’s collapse from $100 to below $2 is a drastic shift that highlights the uncertainty surrounding its valuation. The $100 mark was never truly reflective of Pi Network’s real market value—it was instead a price set by Pi Network IoUs, which were traded on exchanges like BitMart and HTX as placeholders before the official mainnet launch.

Many early adopters, known as pioneers, were frustrated with delays in the network’s progress, leading them to trade these IoUs rather than waiting for the real token. However, once the mainnet launched, exchanges like HTX delisted the IoU version and replaced it with the actual Pi token, which immediately saw a steep drop in price.

Since then, the Pi Network has struggled to regain investor confidence. Unlike its IoU days, when speculation drove prices sky-high, the actual trading market has been far more conservative. With uncertainty still dominating the space, many believe that a return to $100 is unlikely.

Traders Prepare for the Worst

With the mainnet migration deadline now at hand, traders remain wary of what comes next. The possibility of a price recovery still exists, but major obstacles stand in the way. The negative funding rate, technical weakness, and cautious investor sentiment all point toward further turbulence.

Unless something shifts dramatically, the Pi Network could face a prolonged period of instability. While some hold on to hope for a reversal, many traders are bracing for a rough ride ahead.

Crypto News Flash – Read More