The U.S. Securities and Exchange Commission (SEC) is poised to acknowledge filings for spot exchange-traded funds (ETFs) based on Ripple (XRP) and Dogecoin (DOGE) as early as this week. This move signals a potential shift in regulatory attitudes toward digital assets, offering investors new avenues for exposure.

Analysts Anticipate SEC Acknowledgment

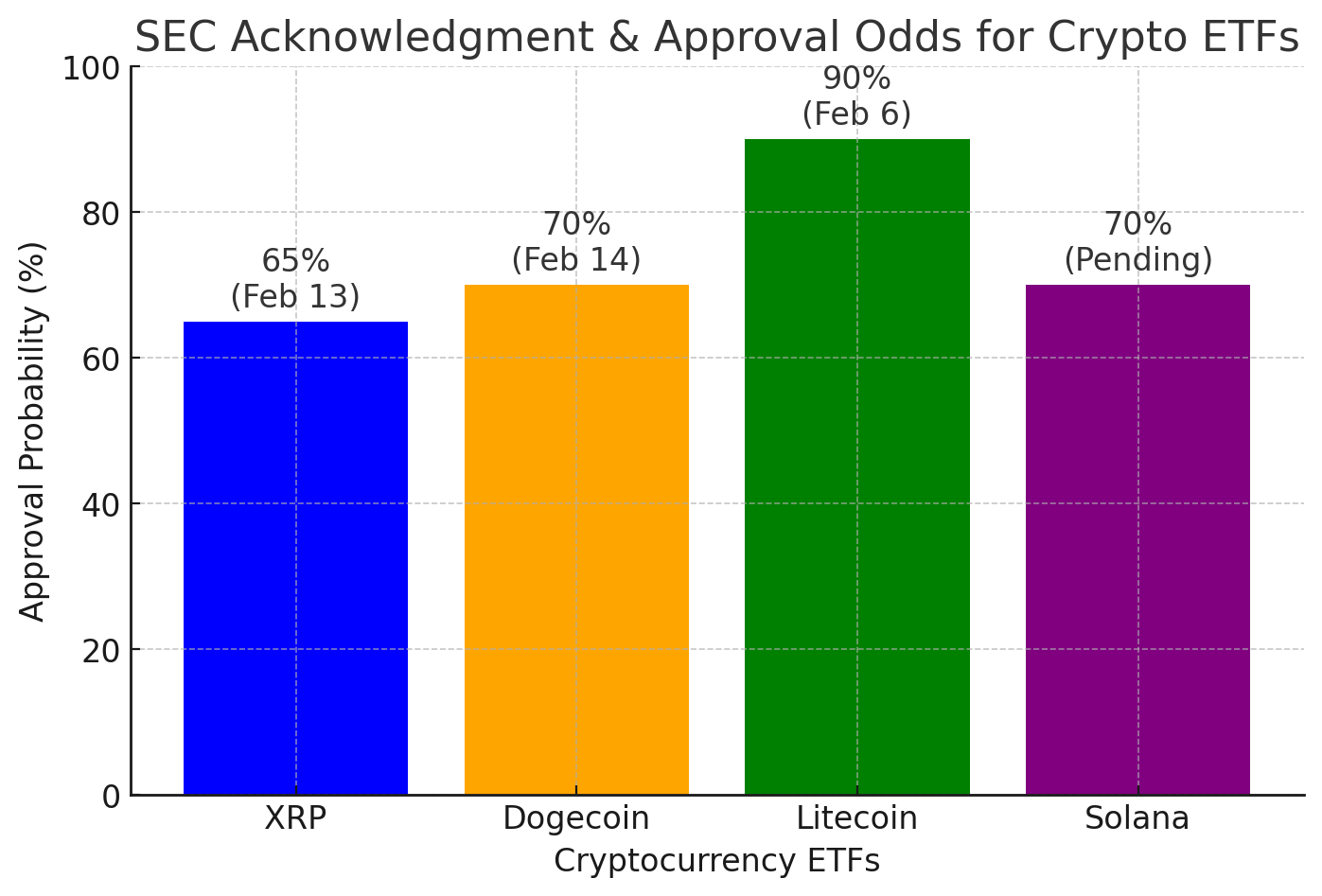

Bloomberg ETF analyst James Seyffart has indicated that the SEC is expected to officially acknowledge the ETF applications for XRP and DOGE imminently. This follows the SEC’s recent acknowledgment of an amended Solana ETF application by Grayscale on February 6. Seyffart, along with his colleague Eric Balchunas, has assessed the approval odds for various crypto ETFs, assigning a 65% chance for Ripple and a 75% chance for DOGE.

The Path to Approval: Key Players and Timelines

Several asset managers have filed S-1 forms for Ripple (XRP) ETFs, including Canary Capital, WisdomTree, 21Shares, and Bitwise. For Dogecoin ETFs, Grayscale and Bitwise are leading the charge. The analysts anticipate that the SEC will acknowledge these filings on February 13 and 14, respectively. Once acknowledged, the SEC will have a set period to review and make final decisions on these applications.

Regulatory Shifts and Market Implications

The anticipated acknowledgment and potential approval of these ETFs come amid significant changes in the regulatory landscape. With the departure of former SEC Chair Gary Gensler and the appointment of Commissioner Hester Peirce’s crypto task force, there is optimism for clearer regulatory guidance by the end of 2025. This includes addressing the longstanding debate over whether certain digital assets should be classified as securities or commodities.

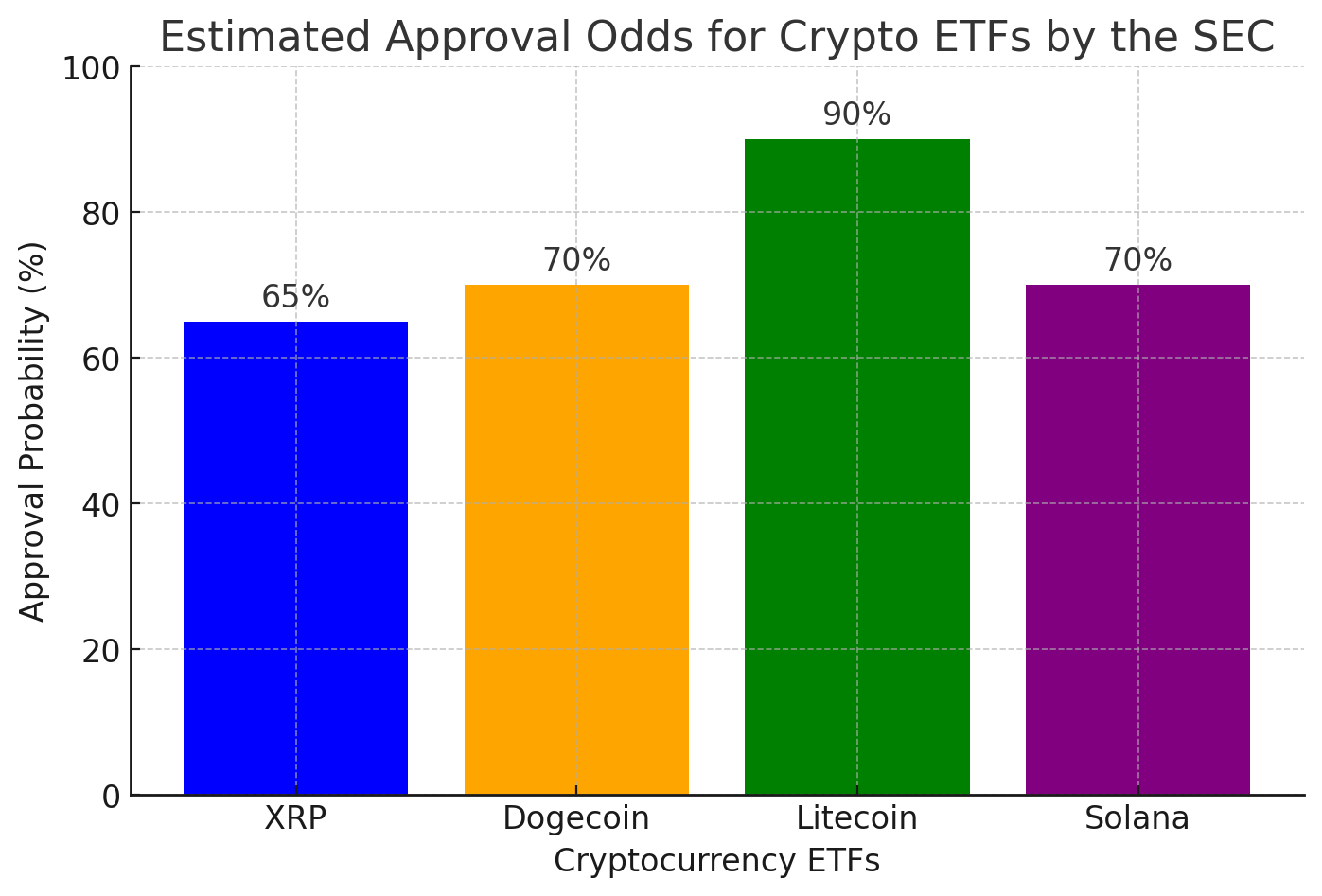

Expert Insights on Approval Odds

Seyffart and Balchunas have provided detailed analyses of the approval odds for various crypto ETFs. They estimate a 90% chance for a spot Litecoin ETF and a 70% chance for a Solana ETF. The higher odds for Litecoin are attributed to its classification as a commodity by the Commodity Futures Trading Commission (CFTC), which may simplify the approval process. In contrast, assets like XRP and Solana have faced regulatory challenges, influencing their slightly lower approval probabilities.

Industry Reactions and Future Outlook

The crypto industry is closely monitoring these developments, recognizing the profound impact that ETF approvals could have on market dynamics. The introduction of ETFs for assets like Ripple (XRP) and DOGE would provide traditional investors with regulated and straightforward access to these cryptocurrencies, potentially increasing liquidity and market stability. As the SEC’s review process unfolds, stakeholders remain optimistic about the future integration of digital assets into mainstream financial products.

Summing up on Ripple and Dogecoin ETFs

In conclusion, the SEC’s forthcoming acknowledgment of Ripple (XRP) and Dogecoin ETF filings marks a pivotal moment in the evolving relationship between regulatory bodies and the cryptocurrency market. As the industry awaits the SEC’s final decisions, the potential approval of these ETFs could usher in a new era of investment opportunities and regulatory clarity for digital assets.

Stay tuned to The BIT Journal and keep an eye on Crypto’s updates. Follow us on Twitter and LinkedIn, and join our Telegram channel to be instantly informed about breaking news!

FAQs

What does it mean when the SEC acknowledges an ETF filing?

Acknowledgment means the SEC has officially received the application and will review it. It does not guarantee approval but is a crucial first step.

What are the odds of XRP and Dogecoin ETFs getting approved?

Analysts estimate a 65% chance for XRP and a 70% chance for Dogecoin based on regulatory trends and market conditions.

Who has filed for XRP and Dogecoin ETFs?

Firms like Canary Capital, WisdomTree, 21Shares, and Bitwise have applied for XRP ETFs, while Grayscale and Bitwise are pursuing Dogecoin ETFs.

When will the SEC make a final decision on these ETFs?

The timeline is uncertain, but analysts expect regulatory clarity by late 2025 as the SEC reassesses crypto policies.

How will an XRP or Dogecoin ETF impact the crypto market?

Approval would provide institutional investors with regulated exposure, potentially boosting adoption, liquidity, and price stability.

Glossary of Key Terms

ETF (Exchange-Traded Fund): A financial product that tracks an asset or index and can be traded on stock exchanges.

SEC (Securities and Exchange Commission): The U.S. regulatory body overseeing securities, including ETFs.

Form 19b-4: A document filed by exchanges seeking SEC approval for listing a new financial product.

Acknowledgment: The SEC’s formal recognition of an ETF filing, starting the review process.

Regulatory Clarity: The process of defining legal frameworks for digital assets, impacting their classification and trade.

Liquidity: The ease with which an asset can be bought or sold in the market.

Commodity vs. Security Debate: A legal issue determining whether a cryptocurrency should be regulated as a security or a commodity.

Sources

The Bit Journal – Read More