What if I told you that the experts are wrong? Over the years several prestigious consulting firms and financial institutions have put out forecasts about the growth of tokenization by the end of the decade. It’s interesting how between all that “expertise,” their ranges vary between $2 trillion (McKinsey) and $16 trillion (BCG). Fourteen trillion dollars is a heck of a lot of spread!

Since 2017, there have been trials to tokenize assets all around the world. Along the way we’ve seen almost every asset class brought on-chain. Today there are more than $50 billion in tokenized stocks, bonds and real estate, with some of the world’s biggest financial institutions, like BlackRock, Franklin Templeton and Apollo starting to invest serious resources into tokenization. Add in over $200 billion in stablecoins (or what we can call tokenized dollars) and we’ve got one quarter of a trillion dollars in RWAs.

What will it look like when the faucet actually turns on? We believe it looks like going from $250 billion today to $30 trillion in 2030, all thanks to the new crypto clarity in the U.S.

A major boon for America and the world

Whether it’s the Fed, the new Crypto Czar, both houses in Congress, or the President himself, this new administration has understood and embraced the benefits of stablecoins to further improve the dollar dominance in the world.

If the U.S. dollar is the world reserve currency for the Web2 world, why not also for the Web3 world? Simply put, the more people that buy stablecoins, the majority of which are in dollars, the better it is for the U.S.A.

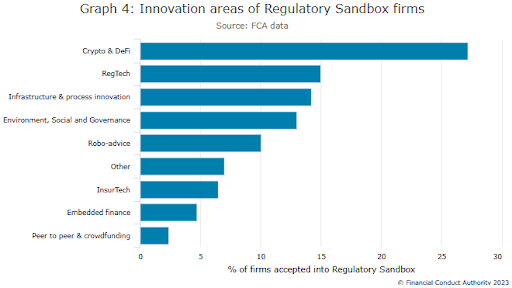

With the right attitude on crypto, we should see market clarity on token classifications (an official taxonomy) and stablecoin market structure in new legislation coming before Congress. Passing such a bill will offer a green light for blockchain to be used in capital markets in the U.S. Previous prediction reports did not factor in this new wave of clarity and government-wide support for crypto, stablecoins, and RWAs.

Stablecoins and yieldcoins (treasury backed tokens) are set to grow significantly from their current $220 billion position, potentially up to $3 to $5 trillion by 2030 if you factor in commercial adoption, digital assets growth, and the demand for yield on-chain.

This RWA use case has not only found product-market fit by crypto users, but it will also become a settlement solution and payment rail for capital markets in general. All assets can now transact on a new, nearly-instantaneous financial operating system using blockchain to go in and out of any tokenized Real World Asset (RWA) or crypto asset using stablecoins.

The tokenization revolution is inevitable. Which is actually what the CEOs of BlackRock and JP Morgan have been openly saying and acting on.

It can’t possibly all be tokenized, can it?

Most critics will laugh at the notion that the over one hundred trillion in stocks or hundreds of trillions in real estate, or trillions in private companies, or trillions in commodities, or trillions in bonds and credit could all be tokenized. In a few years those critics will be saying tokenization is a necessity and that it’s the innovation of the century for finance (because it is).

The answer is yes, it can all be tokenized.

It’s more of a question of how fast will each asset class take advantage of migrating on chain. Some assets will feel more pressure to adapt while other assets are so large it doesn’t take much to move the needle to suddenly get to trillions either via new asset issuance, tokenized asset growth, or simply legacy assets migrating on-chain.

My conversations with banks, asset managers, crypto exchanges, and industry leaders tells me that there is a renewed spirit for asset tokenization with the difference being that the traditional finance sector and regulators now better understands the benefits of blockchain technology, implying that the growth of asset tokenization will happen faster than previously forecast.

Here are some other reasons our forecasts are higher than previous estimates:

When we look at some of the past forecasts, some of them like HSBC and Northern Trust use a methodology that relies on calculating the size of the asset class and applying a nominal percentage of adoption or in their case a range of 5-10% of total assets. Others like Standard Chartered allude to specific asset classes growing faster than others or in their case citing 14% of $30 trillion of assets by 2034 coming from trade finance. STM’s methodology breaks down the eight largest asset classes in the world and considers regulatory and government support as a key factor of growth. Imagine if California’s title registry went on-chain. That’s a residential home market of $10 trillion that could be put on a blockchain virtually overnight. Thanks to new market clarity in the U.S. and the success of stablecoins, we expect faster blockchain adoption around the world, leading to $50 trillion in RWA annual trading by the end of the decade.

It’s time to open the faucet. Happy tokenizing!

Please see the full report here.

CoinDesk: Bitcoin, Ethereum, Crypto News and Price Data – Read More