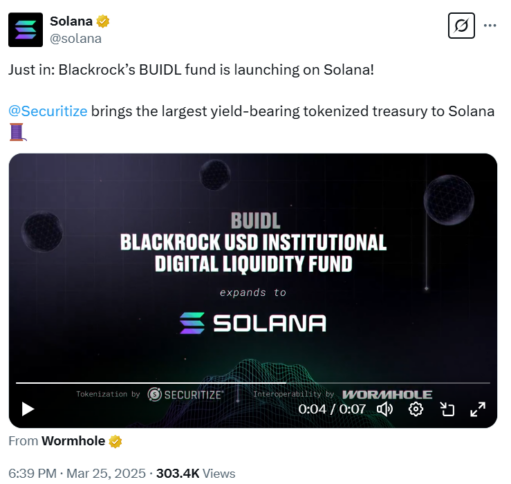

Securitize has announced that the BlackRock USD Institutional Digital Liquidity Fund (BUIDL) is now available on the Solana blockchain.

As per the announcement, this move expands access to BUIDL, which recently hit $1 billion in assets under management.

BUIDL, the first tokenized fund issued by BlackRock on a public blockchain, was introduced by Securitize and BlackRock in March 2024. It allows qualified investors to earn U.S. dollar yields on-chain with daily dividend payouts, flexible custody, and fast peer-to-peer transfers.

BUIDL is now live on seven blockchains—Aptos, Arbitrum, Avalanche, Ethereum, Optimism, Polygon, and Solana. Wormhole enables secure cross-chain transfers, expanding access for investors, DAOs, and digital asset firms.

Securitize CEO Carlos Domingo said that demand for tokenized real-world assets (RWAs) has grown over the past year, proving the value of bringing institutional investments on blockchain. He added, “BUIDL to Solana—a blockchain known for its speed, scalability, and cost efficiency—is a natural next step.”

Solana Foundation President Lily Liu explained that Solana’s fast, low-cost transactions and strong developer community make it a great choice for tokenized assets. She said BlackRock’s move to Solana gives users a more efficient and innovative network.

BUIDL is backed by custodians such as Anchorage Digital, Copper, and Fireblocks, with Bank of New York Mellon holding its cash and securities.

Also Read: BlackRock to launch Bitcoin ETP is European Markets

The Crypto Times – Read More