While the short-term trends are mixed, Solana’s long-term fundamentals remain strong, keeping its $300 price target within reach as momentum shifts. And with crypto and AI Czar David Sacks scheduled to hold a press conference today on the future of digital assets in America, SOL could be in for a big boost. If Sacks announces further details on an American Digital Asset stockpile that contains SOL, and XRP, the price of SOL and XRP will explode. Sacks is himself, a holder of Solana.

Can Solana Recover and Still Target $300?

While Solana’s drop below $200 was concerning, its fast recovery was reassuring. For SOL to continue bullish momentum, it must reclaim $212-$220 as support and break through resistance at $250. A sustained push past $280 would then set the stage for a run toward $300 in the coming months.

Solana (SOL) could hit $300 if the price rebounds above $200. Source: AhmedMesbah on TradingView

A swing failure pattern has emerged, signaling a potential bullish reversal as buyers step in to defend key support levels. The MACD indicator also reflects a decline in selling momentum, which could mean a possible bullish crossover is in the works. The RSI is steady at 61.37, indicating that further gains could be made without reaching overbought status.

The price action of SOL continues to be confined within a range, strongly supported at $181 and strongly resistant at $296. A proper close above $250 may accelerate the gains toward the $280-300 region in the upcoming weeks. Conversely, failure to hold above $212 could lead to a retest of lower support levels near $181.

Watch – Solana Technical Analysis

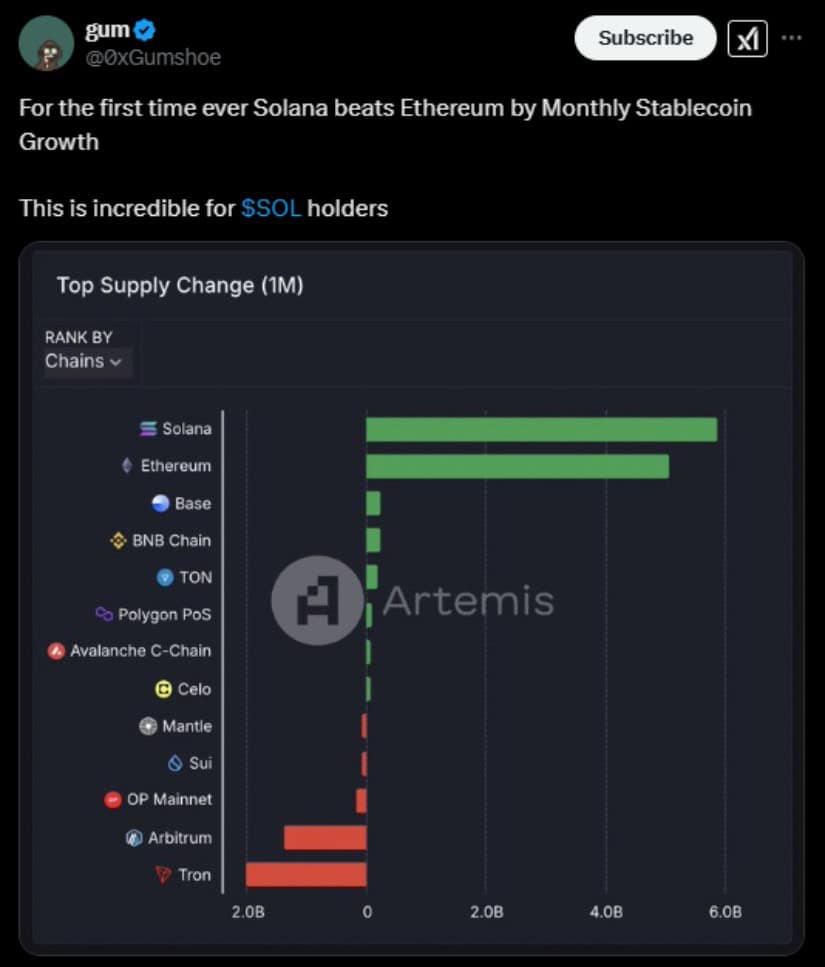

Why Solana Outpaces Ethereum

The founder of Pump.fun recently weighed in on Solana’s success, emphasizing its superior user experience, deep liquidity, and a native token that appreciates alongside adoption. These factors have allowed Solana to reach what he calls an “exit velocity,” cementing its position as a market leader.

Solana beats Ethereum by monthly stablecoin growth. Source: Gum via X

In contrast, Ethereum’s Layer 2 solutions have faced fragmentation, limiting their ability to scale efficiently. As multiple L2s compete for liquidity and user attention, Ethereum struggles to maintain seamless integration across its ecosystem. This has raised concerns about whether Ethereum’s scaling roadmap can keep up with Solana’s rapid adoption.

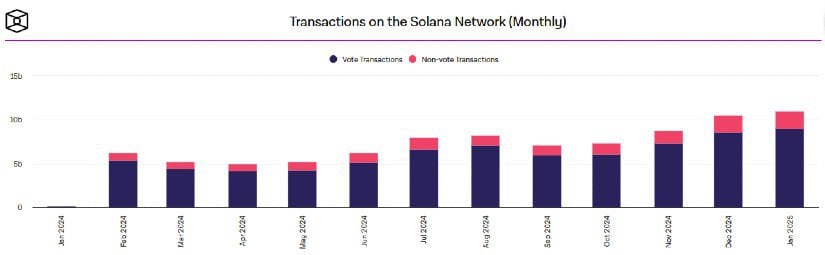

On-Chain Data Reflects Solana’s Strength

Solana continues to dominate decentralized exchanges (DEXs), demonstrating its ability to handle high-speed transactions at low fees. The network processed over $258 billion in trading volume in January alone, bringing its total to nearly $1 trillion. If this trend continues, Solana is expected to cross the $1 trillion milestone in February.

Solana’s monthly transaction volume is on a rising trend. Source: The Block

Additionally, the launch of new meme coins and high trading activity on platforms like Orca, Meteora, and Raydium further reinforce Solana’s ecosystem strength. Unlike Ethereum, which relies heavily on Layer 2 solutions for scaling, Solana’s monolithic architecture allows it to maintain efficiency without added complexity.

Market Sentiment and Future Projections

Solana retreated to the $188 zone in a broader market correction that saw Bitcoin briefly dip below $100,000 and the total crypto market cap decline by nearly 4% to $3.4 trillion. The market recovered faster than expected as Trump made a deal with Mexico and trade war fears subsided.

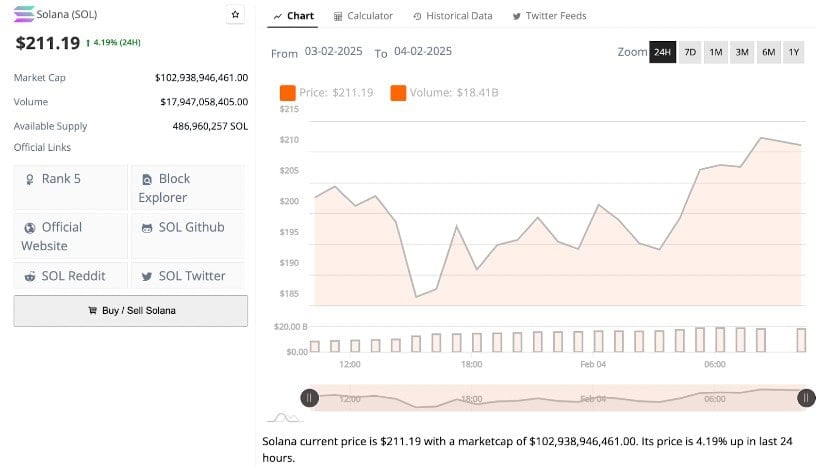

Solana (SOL) traded as low as $188, but recovered strongly to $211. Source:Brave New Coin

Still, investors believe in the long-term prospects of SOL. An ever-expanding ecosystem, growing activity from developers, and institutional interest form a very good base for further growth. If Solana continues at its current pace, the $300 target will also not be unreachable.

Looking Forward

Solana’s recent dip below $200 highlights the challenges of short-term volatility, but its long-term outlook remains bullish. While a break toward $300 may take longer than expected, strong developer activity, institutional interest, and network expansion continue to support SOL’s growth.

Investors should watch key support and resistance levels in the coming weeks, as a potential recovery could signal whether Solana is ready for its next bullish leg. If David Sacks has good news for SOL investors, then sentiment could quickly change for the positive and Solana could explode.

Brave New Coin – Read More