- Solana active addresses increase by 1.5M in nine days

- Price drops from $221 to $188 amid weak inflows

- Technical battle focuses on $201 resistance level

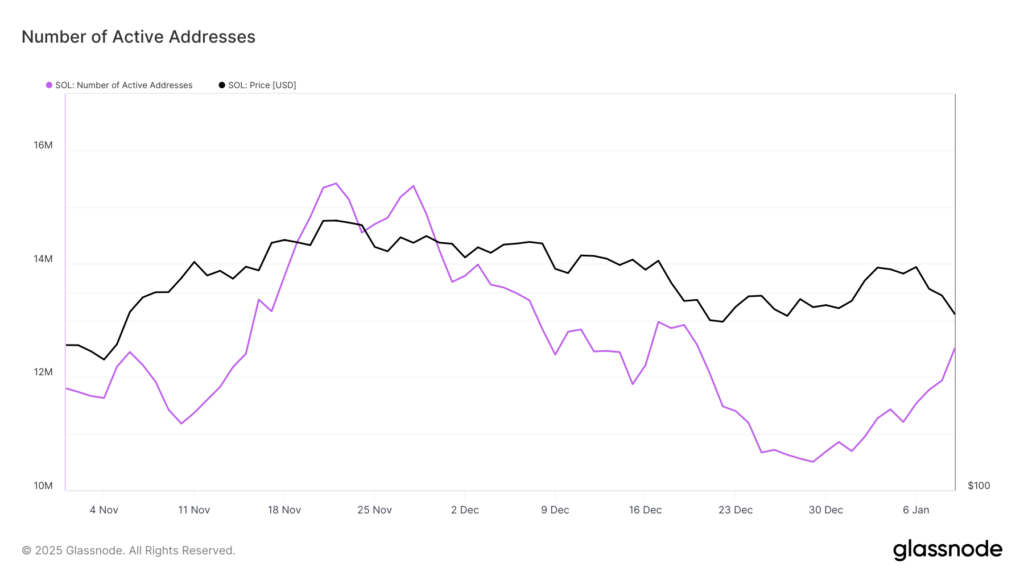

Solana’s recent price action presents an interesting paradox between growing network participation and declining market value.

The drop from $221 to $201 over three days highlights the complex relationship between investor sentiment and actual market behavior, creating a situation where increasing network activity has yet to translate into price appreciation.

The surge in active Solana addresses provides fascinating insight into market psychology. With 1.5 million new addresses conducting transactions since the year began, we’re witnessing significant growth in network participation.

However, this increased activity creates an intriguing disconnect – while more participants are engaging with the network, their actions haven’t generated sufficient buying pressure to support price levels.

The Chaikin Money Flow (CMF) indicator helps explain this disparity by revealing relatively weak capital inflows. Despite the growing number of active addresses, the limited flow of new capital into SOL suggests that participants are engaging with the network without committing substantial funds.

This behavior pattern often indicates cautious optimism – investors are interested enough to participate but not yet confident enough to make significant financial commitments.

Currently trading at $188, Solana faces a critical technical test at the $201 resistance level. The recent reclamation of $186 support provides a foundation for potential recovery, though the path forward depends heavily on whether growing network activity can finally translate into meaningful capital inflows.

A failure to maintain current levels could trigger a retreat toward $175, highlighting the precarious balance between network growth and market valuation.

TheNewsCrypto – Read More