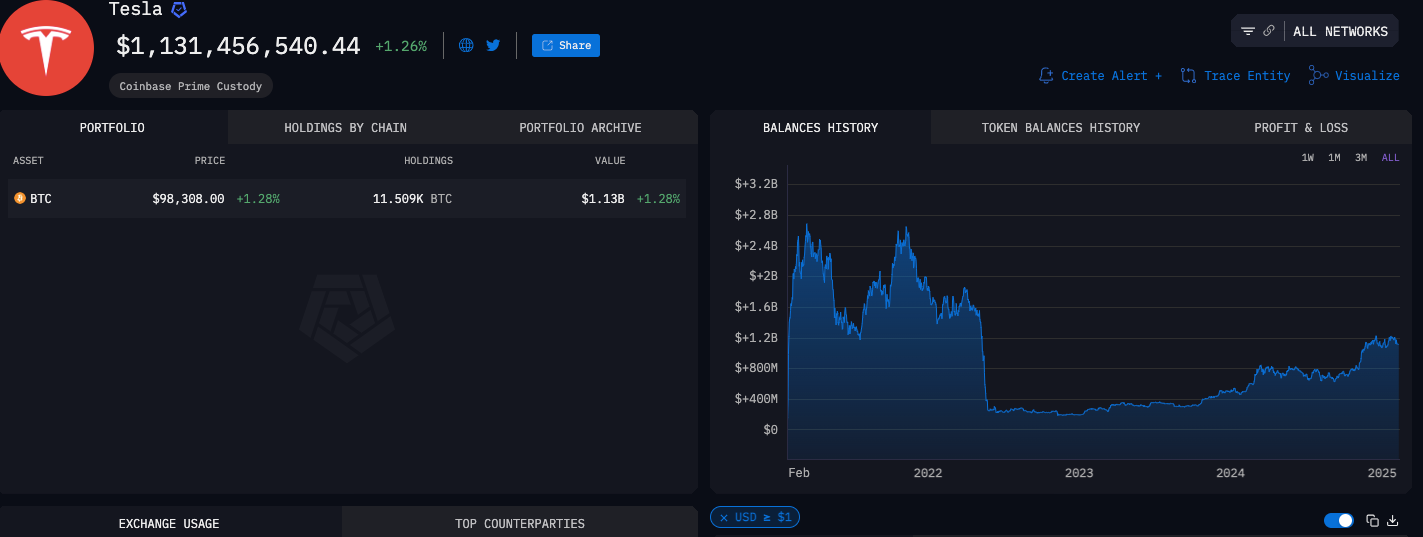

According to Arkham Intelligence data, Tesla generated a $600 million profit from Bitcoin during the fourth quarter of 2024. The company earned Bitcoin profits by riding the cryptocurrency market up to $109,000 without buying additional Bitcoin. The latest SEC disclosure from Tesla reveals that the company preserves ownership of 11,509 BTC, which currently has a value of about $1.1 billion.

Bitcoin’s Market Surge Benefits Tesla

The increase in the Bitcoin market fuelled Tesla’s financial performance, which led to profitable business operations without needing extra funds. Tesla arranged for $1.5 billion of Bitcoin purchases during 2021 and acquired 39,474 BTC units as part of the transaction. Tesla moved on to sell 70% of its Bitcoin stash in 2022, yet the rest of its Bitcoin grew extraordinarily in value.

Tesla experienced a significant increase in its financial results because Bitcoin recently maintained a rising value. New accounting rules allowed Tesla to evaluate assets through actual market values, which contributed significantly to the company’s profit growth during its latest financial period.

Fair-Value Accounting Rules Drive New Profits

Tesla experienced positive effects because the Financial Accounting Standards Board (FASB) implemented new fair-value accounting rules in December 2024. Before December 2024, companies needed to report the loss of value of digital assets when the value of Bitcoin declined, even if there was no actual sale of assets. Under the new regulations, institutions can document Bitcoin using its present market value instead of requiring it to use the lowest transaction price from the reporting period.

The new regulation enabled Tesla to achieve precise fair-value measurement of its Bitcoin holdings, allowing it to instantly state Bitcoin profit and loss. Tesla’s SEC filing states that the fair-value adjustment produced a $523 million beneficial change in its financial reporting results. New rules introduced by the SEC let businesses implement Bitcoin more freely as a resource without depending on obsolete valuation standards.

Bitcoin as a Treasury Asset for Corporations

The recently introduced FASB rules simplify corporations’ process of adding Bitcoin assets to their treasury assets. A business can employ Bitcoin as collateral to obtain working capital instead of triggering tax revenue by selling its assets. The technique lets companies to obtain market funds yet protects their future price appreciation possibilities.

According to informed industry expert Glover, businesses have the option to obtain financial loans collateralized by their Bitcoin holdings while bypassing sales transactions. The income generated by Bitcoin deposits ranges between 3% and 4% based on current market demands in lending activities. As a result of these advances, Bitcoin has expanded its usefulness for business finance departments, enhancing its position within corporate financial operations.

Bitcoin gained legitimacy for corporate financial usage following the approval of spot Bitcoin exchange-traded funds (ETFs). Companies are projected to increase their Bitcoin balance sheet adoption since regulatory guidelines have become more apparent. The expanding investment confidence in digital assets now views them as safe long-term investments.

Tesla Yet to Resume Bitcoin Payments

The increase in Bitcoin’s green energy use by over 50% has not led Tesla to restart cryptocurrency payments. Previously, Elon Musk declared that Tesla would restore Bitcoin transactions after the cryptocurrency achieved sustainability in energy usage. The company has not released any news regarding this change since February 2025.

Bitcoin’s total energy consumption exceeds Musk’s threshold since it now derives 57% of its power from sustainable sources. Since this progress in Bitcoin sustainability, multiple investors and supporters anticipated Tesla would re-enable payments through Bitcoin. The prolonged delay in cryptocurrency payments leads to speculation about Tesla’s potential change of mind regarding cryptocurrency as a payment option.

The company ceased Bitcoin payments in 2021 because of environmental issues. It specified an environmentally friendly mining procedure as its prerequisite for bringing Bitcoin payments back. Bitcoin’s improved energy efficiency creates anticipation for Tesla to share information about its payment procedures.

Conclusion

Tesla’s $600 million Bitcoin profit in Q4 2024 highlights the impact of new fair-value accounting rules. The 11,509 BTC held by the company resulted in profit because Bitcoin prices increased to over $109,000. Financial reporting that enables corporations to record market values for cryptocurrency holdings creates greater business agility and promotes them to keep holding digital assets.

More companies use Bitcoin as a treasury asset for liquidity instead of conducting sales. Tesla’s extended period of Bitcoin payment suspension continues to spark criticism among investors, even after the company improved energy efficiency. Regulatory developments and market trends will shape Tesla’s business approach regarding Bitcoin usage.

FAQs

How did Tesla make $600 million in Bitcoin profits?

Tesla gained from Bitcoin’s price increase in Q4 2024, which allowed it to record profits without selling its holdings.

What are the new fair-value accounting rules?

The rules allow companies to report digital assets at market value instead of their lowest value during an accounting period.

Why has Tesla not resumed Bitcoin payments?

Although Bitcoin’s sustainable energy usage surpassed 50%, Tesla has not announced payment reinstatement.

How much Bitcoin does Tesla still hold?

Tesla holds 11,509 BTC, worth approximately $1.1 billion as of February 2025.

What is the impact of spot Bitcoin ETFs?

Spot Bitcoin ETFs have increased institutional adoption, making Bitcoin a more viable treasury asset for corporations.

Glossary

Fair-value accounting: A financial reporting method that values assets based on their current market price rather than historical cost.

SEC Filing: A report submitted to the U.S. Securities and Exchange Commission detailing a company’s financial information.

Spot Bitcoin ETF: An investment fund that holds actual Bitcoin and allows investors to gain exposure without buying the cryptocurrency directly.

Corporate Treasury: To optimize liquidity and returns, a company manages financial assets, including cash and investments.

Bitcoin balance sheet: A Bitcoin portfolio balance sheet outlines your Bitcoin and digital asset holdings alongside traditional investments such as stocks and bonds.

Reference

Securities and Exchange Commission

The Bit Journal – Read More