The Blockchain Group of France has bought the largest amount of Bitcoin for its enterprise treasury thus far with its recent purchase of 580 BTC. Since introducing Bitcoin in its corporate holdings during November 2024 the company has registered a 225% market value increase.

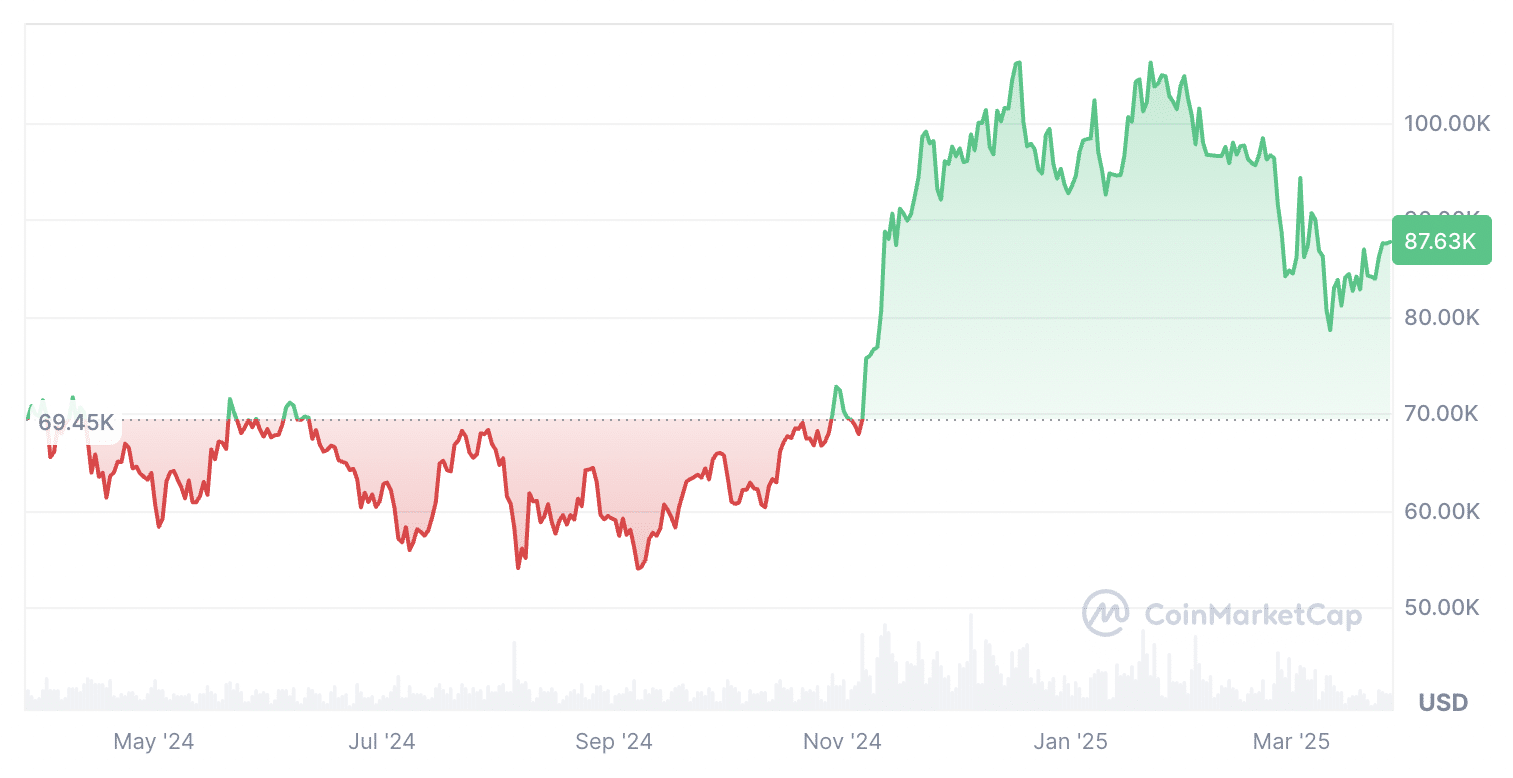

An official announcement on March 26 reveals the company has purchased additional bitcoins while growing with other companies that now use bitcoin. The buyout happened when Bitcoin was trading at $87,311, and the deal’s worth came to $50.64 million through CoinMarketCap’s information.

The Blockchain Group’s Strategic Bitcoin Entry

The Blockchain Group began buying Bitcoin on November 5, 2024 as it happened during the U.S. Presidential Election day. The company entered the market right as Bitcoin started its explosive growth which reached its peak at $100,000 on December.

The firm bought 25 Bitcoin on December 4, 2024 when the price stood at $96,000 through a second acquisition. The company made its Bitcoin purchase during the run-up to the $100,000 mark which Bitcoin achieved the next day.

ALTBG’s Strategic Investment and Growth

The purchase on March 26 does not align with any market events but is strategically positioned before the end of Q1 2025 when Bitcoin often lags its previous annual performance. One year before Bitcoin experienced its halving event on April 20, investors follow a historically positive trend for digital currency.

The Blockchain Group serves as a global holding firm with its shares listed on Euronext Paris under ALTBG symbol and delivers AI, data intelligence, and decentralized technology services through its sister companies. After starting its Bitcoin investment program ALTBG experienced 225% growth in its stock price which now stands at 0.48 euros ($0.52) according to Google Finance data.

Strategic Bitcoin Purchases for Financial Growth

The firm purchases Bitcoin as part of its strategy to allocate extra cash while using financial instruments to enhance its financial statement. On March 26 the company made its latest acquisition announcement after the markets closed to match a similar move made in the U.S.

The Blockchain Group purchased Bitcoin at the same time as GameStop experienced a stock price rise because the retailer announced it would trade in Bitcoin. The GameStop stock price jumped 12% on March 26 due to its conversion notes offering to fund Bitcoin acquisitions.

Strategy’s Bitcoin Holdings Cross 500,000 BTC

N7 Capital founder Anton Chashchin observes the situation might motivate other companies to invest in Bitcoin assets. American investor Jason Calacanis believes publicly traded companies should invest in Bitcoin because it may offer them a way to replace failing business models.

Through ongoing Bitcoin purchases Strategy proves itself as the foremost corporate Bitcoin leader by moving past 500,000 BTC assets. In three months from November to January Strategy kept buying Bitcoin for 12 straight weeks which supported the rise of institutional investors.

Conclusion

The Blockchain Group keeps advancing its Bitcoin investment path while people study its stock results and impact on the market. Market observers now watch businesses jumping into Bitcoin to measure if other companies will enter and influence currency acceptance.

Follow us on Twitter and LinkedIn, and join our Telegram channel to be instantly informed about breaking news!

FAQs

Why did The Blockchain Group buy 580 Bitcoin?

To utilize excess cash and financing instruments as part of its Bitcoin strategy.

How has its stock price reacted?

ALTBG surged 225% since it started buying Bitcoin in November 2024.

What were its previous Bitcoin purchases?

15 BTC on Nov. 5 and 25 BTC on Dec. 4, tied to key Bitcoin events.

How does this compare to other companies?

Similar to GameStop and MicroStrategy, which also invest heavily in Bitcoin.

Glossary Of Key Terms

Bitcoin (BTC) – A decentralized digital currency.

Bitcoin Treasury – A company’s Bitcoin holdings.

Stock Surge – A sharp rise in share price.

Euronext Paris – A major European stock exchange.

Bitcoin Halving – Event reducing BTC mining rewards.

Convertible Notes – Debt that can convert to equity.

References

Read More: The Blockchain Group Buys 580 BTC—Enterprise Bitcoin Strategy Pays Off Big“>The Blockchain Group Buys 580 BTC—Enterprise Bitcoin Strategy Pays Off Big

The Bit Journal – Read More