Cryptocurrency research firm Alphractal has published a new statement analyzing Bitcoin’s current market position and highlighting the importance of a key metric in determining future price trends.

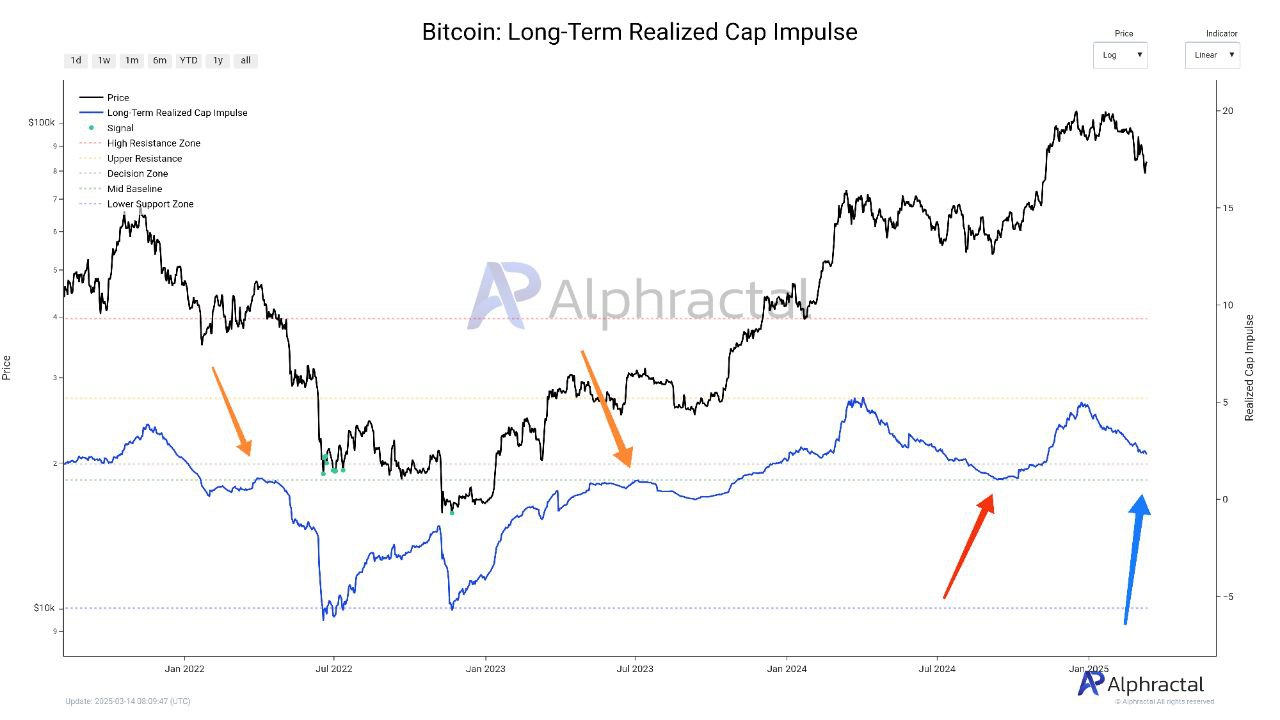

According to Alphractal, Bitcoin is approaching a critical level in the Long-Term Realized Value metric, which has historically acted as a key support or resistance zone. Maintaining a position above this level is seen as a bullish signal indicating strength in the market and potential continuation of the uptrend. However, falling below this important threshold could signal the start of a new Bearish cycle.

By focusing on longer time windows, Long-Term Realized Capital Impulse helps identify structural market shifts that are not visible in short-term analysis. It also sheds light on large capital flows, providing valuable context for investors looking to make data-driven decisions based on past market behavior.

Bitcoin is trading at $84,780 at the time of writing and has gained 5% in the last 24 hours.

*This is not investment advice.

Continue Reading: This Signal Must Appear for Bitcoin to Turn Bullish, Says Analytics Company

Bitcoin Sistemi – Read More