Trump Meme Coin Official Trump ($TRUMP) appears excluded from the very wave of “meme coin mania” it created, subdued by a recent legal hit.

Speculators seem to be distancing themselves from the coin, with Wednesday’s legal action bolstering a 31.42% decline for the week.

Coupled with a 30.52% decline in trading volume to $1.69B, it seems that $TRUMP’s recent tailwinds have faded – spurring forecasts of a complete collapse.

Trump Meme Coin In Hot Water, Public Citizen Says

Government watchdog group Public Citizen filed a legal complaint with the Department of Justice and the Office of Government Ethics on February 5.

The group is urging an investigation into whether Trump violated federal laws by promoting and soliciting money for his Official Trump meme coin.

They argue that its continued promotion, post-inauguration, constitutes a potential violation of federal laws prohibiting the president from soliciting personal gifts.

The implications of which extend to potential national security and foreign policy risks.

The US Constitution forbids any president from accepting money or items of value from foreign sources —something difficult to track given crypto’s decentralized and anonymous nature.

In response to backlash, Trump recently denied knowledge of any proceeds from the meme coin.

TRUMP Price Analysis: Is This the Beginning of the End?

These developments come as $TRUMP reaches a critical technical juncture, retesting the upper resistance of the descending channel it has followed since mid-January.

Despite bearish fundamentals, technical indicators remain stable.

The MACD line has maintained its position above the signal line, narrowly avoiding a death cross— a move that often precedes major declines.

It is uncertain if this strength has staying power, though, as the MACD line displays a weak uptrend.

More so, the Relative Strength Index (RSI) remains stagnant within the neutral but bearish 40s. While this has improved from the 30s the week prior, the bears remain firmly in control of price movements.

Given a breakout materializes, the pattern sets a potential $27.60 price target, representing a 55% advance on current prices.

More credibly, $TRUMP stands to be rejected without sufficient support for a sustained breakout, triggering a potential fall to retest the pattern’s lower support.

This outcome could see a bottom as low as $7, a potential 60% decline from current prices. A complete collapse would likely hinge on this support being maintained.

This New Meme Coin Could Be the Better Pick

While $TRUMP has made its mark on the meme coin scene, its value—rooted in hype—relies heavily on its association with Donald Trump.

With mounting legal headwinds, the coin risks losing the very backing that catapulted it to prominence.

Therefore, it is no surprise that traders now seek alternative investments that aren’t as tightly bound to sentiment but have real utility.

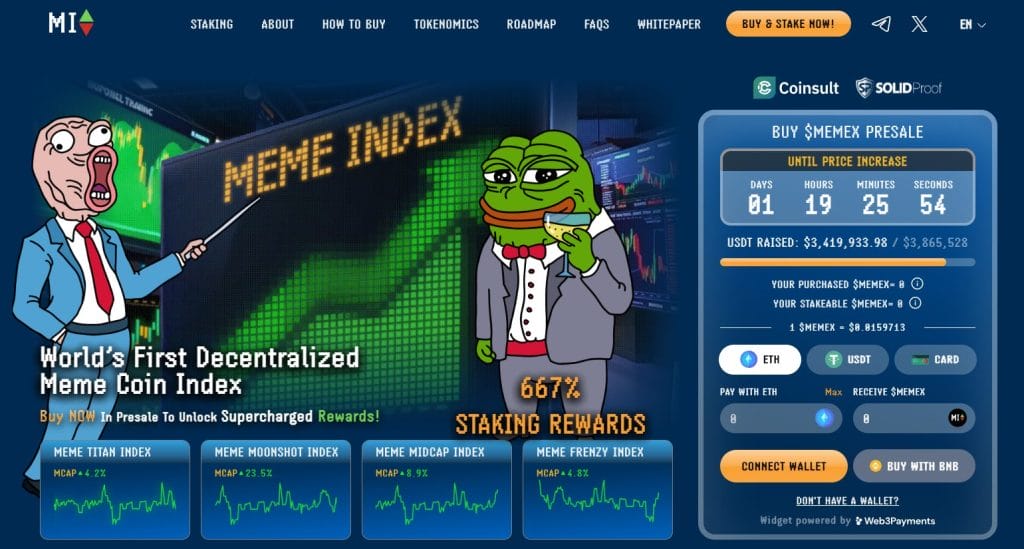

One standout option is Meme Index ($MEMEX), the world’s first decentralized meme coin index.

The Meme Index offers a curated selection of meme coins that balances high growth potential with smart risk management.

With four distinct baskets, investors can customize their strategies, whether aiming for steady growth or taking on higher-risk, higher-reward opportunities.

By holding $MEMEX, investors can also earn passive income through staking, with an impressive APY of 677%—though this rate will decrease as participation grows.

Having already raised almost $3.5 million in its presale, Meme Index is gaining strong momentum and is positioned for even greater growth ahead.

Join Meme Index on X (formerly Twitter) and Telegram to stay updated on the latest announcements.

The post Trump Meme Coin Hit With Legal Complaint – Is a Total Collapse Coming? appeared first on Cryptonews.

News – Read More