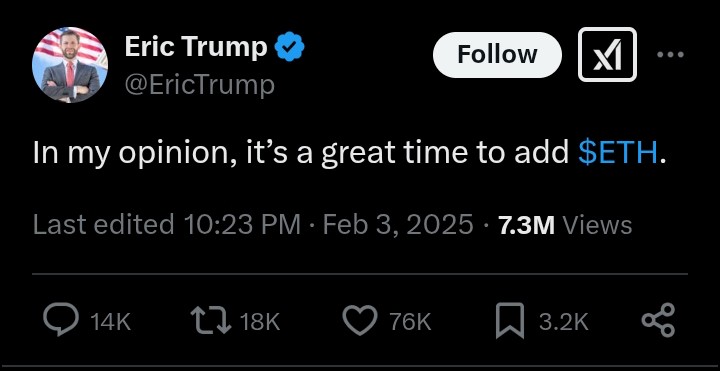

- Trump’s son has posted on X that this is a “great time to buy ETH” after his Decentralized Finance (DeFi) company purchased $10 million worth of the asset.

- An analyst has linked the recent downturn to a significant change in market sentiment as ETH trends below MVRV (160D-MA).

The son of US President Donald Trump, Eric Trump, has jumped on the Ethereum (ETH) bandwagon as he pronounces that this is the best time to add more of the asset.

At the time of his post, on February 3, the broad crypto market was in recession, with Ethereum declining to below the crucial support range of $2.5k and $3k. However, the market appears to be bouncing back as ETH returns to $2.8k after printing a 4% surge on its daily price chart.

Trump’s Involvement with ETH could be traced to its multiple purchases by his family’s Decentralized Finance (DeFi) platform, World Liberty Financial (WLF). According to reports, Donald Trump is listed as the Chief Crypto Advocate of the company, while his sons, Eric Trump and Donald Trump Jr., are listed as Web3 ambassadors.

Per our research, WLF purchased $10 million worth of Ethereum on January 31 to bring its holdings to 66,239 ETH ($225 million). Prior to that, the company had purchased $10 million worth of ETH on January 28. In our last update, we also indicated that the company has spent $48 million USDC on 14,403 ETH at $3,333 per coin. As we mentioned in another news brief, WLF recently transferred $61.4 million in ETH for claimed Treasury management.

Recent Ethereum (ETH) Pullback

According to a renowned crypto analyst called Ali Martinez, the ETH future looks blurry as the asset earlier trended below the MVRV (160D-MA). After this occurrence, the asset recorded a 40% correction. Additionally, the recent pullback was attributed to a significant shift in sentiment as ETH long-term holders liquidated their positions. Fascinatingly, the $2,230 and $2,610 region was highlighted as a crucial support area as almost 12 million wallets bought 62.27 million ETH.

Meanwhile, Martinez pointed out earlier that ETH was forming an inverse head-and-shoulders pattern with the $2,800 and $3,000 meant to form a major support. The $4000 remains a major psychological level of this formation, as a break above this point could position ETH at $6,770.

Exploring expert analysis on the asset, we found an interesting thesis by one crypto trader identified as expert Max. In his last week post, Max disclosed that ETH was facing a critical moment labelled “make or break”. According to him, the inability of the asset to complete a specific pattern might lead to a serious breakdown.

Backing his thesis with a chart, Max explained that it lacked substantial support for its existing price. With that, he predicted that a fall below the $3000 level would see the asset finding support at the $2,400 level. Fascinatingly, ETH touched this predicted level before recording a bounce back to the current price. Amidst the backdrop of this, Ethereum reserves have hit a six-year low, as highlighted in our previous article.

Crypto News Flash – Read More