- Trump’s tariff announcement triggered Bitcoin and major crypto declines, with $2B in record liquidations.

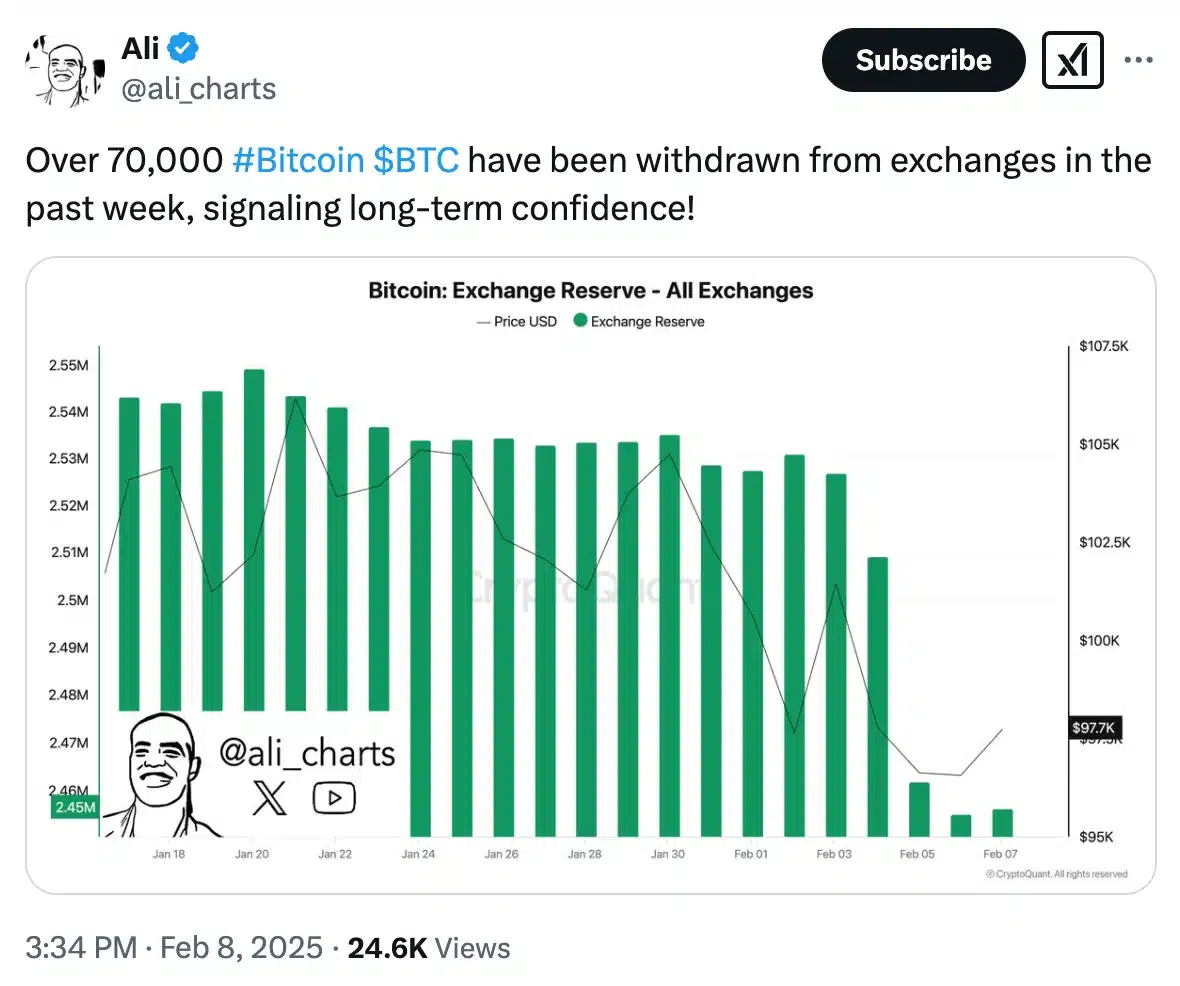

- Large investors withdrew 70,000 BTC from exchanges, signaling long-term confidence despite current market volatility.

President Donald Trump’s announcement of reciprocal tariffs on February 7, 2025, triggered immediate turbulence across global financial markets, including cryptocurrencies. The policy, targeting unspecified nations but suspected to prioritize the European Union, aims to recalibrate U.S. trade relationships.

While Trump framed it as ensuring “even treatment” for American interests, markets reacted with volatility. Bitcoin fell sharply alongside assets like Solana and Dogecoin, echoing a pattern seen during prior tariff announcements.

The crypto market recorded over $2 billion in liquidations within 24 hours of the news, surpassing levels seen during the 2020 COVID-19 crash or FTX’s collapse. A prominent investor, known as *The Wolf of All Streets*, described the sell-off as “epic,” highlighting its severity.

ETHNews analysts attribute this sensitivity to cryptocurrencies’ growing integration with macroeconomic trends, where geopolitical shifts now directly influence digital asset prices.

Despite short-term instability, large investors are accumulating Bitcoin. Blockchain analyst Ali Martinez reported that over 70,000 BTC left exchanges in the past week, suggesting institutional players view current prices as strategic entry points.

Martinez noted: “Negative sentiment often signals buying opportunities”* implying confidence in Bitcoin’s long-term resilience. This accumulation contrasts with retail traders’ panic, underscoring a divide in market participation.

Recent data reveals cautious optimism. The global crypto market cap rose 1.88% to $3.19 trillion in 24 hours, signaling partial recovery. Bitcoin’s price stabilized near $98,000 after initial drops, while Ethereum and Solana mirrored this rebound.

The tariff debate intersects with broader questions about Bitcoin’s role as a hedge. Proponents argue its decentralized nature shields it from policy shifts, but recent events challenge this narrative. Meanwhile, U.S. regulators continue evaluating frameworks for digital assets, a process complicated by election-year politics.

As markets await further tariff details by February 11, 2025, the episode underscores crypto’s dual reality: vulnerable to macroeconomic shocks yet increasingly embraced as a strategic asset. For now, whales bet on calm after the storm, while traders brace for the next ripple.

The post Trump’s Tariff Strategy Shakes Crypto Markets as Whales Accumulate Bitcoin appeared first on ETHNews.

ETHNews – Read More