Once considered the “Wild Wild West,” the cryptocurrency sector is finally being recognized as a regulated industry.

Currently, regulations centered around digital assets are well underway in the United States.

Following President Donald Trump’s inauguration on January 20, 2025, the new Administration has begun focusing US policy on blockchain technology and digital assets.

US Crypto Regulations Take Shape

For example, Trump’s Administration immediately took measures to cancel the Securities and Exchange Commission (SEC) Staff Accounting Bulletin (SAB) 121.

If passed, this legislation would have required financial institutions to treat crypto assets held in custody as if these were held on balance sheets.

President Trump also signed an Executive Order (EO) outlining a roadmap for regulating digital assets and blockchain innovation.

According to Grayscale Research, the most important feature of the EO is its statement of support for the industry’s foundational principles.

These include the right to access open networks, develop and deploy software, participate in mining and staking/validating, transact on a peer-to-peer basis, and self-custody digital assets.

Meanwhile, Anthony Scaramucci – founder of SkyBridge Capital and former White House director of communications during US President Donald Trump’s first term – has suggested that members of Congress will act in favor of the crypto industry before the 2026 midterm elections.

MiCA Rules Enforced in Europe

As crypto regulations take shape in the US, the European Union’s Markets in Crypto-Assets (MiCA) regulation is set to redefine Europe’s cryptocurrency sector.

Several EU-based cryptocurrency exchanges have already secured MiCA licenses. These licenses allow centralized exchanges to operate across the 30 countries within the European Economic Area (EEA).

This also allows “passporting,” which allows registered and licensed businesses to offer services to other EU countries under a unified regulatory framework. This rule is intended to simplify crypto access for EEA residents.

In addition, MiCA regulations have resulted in the delisting of non-compliant stablecoins. Crypto exchanges like Kraken and Crypto.com have recently removed support for Tether’s USDT.

Isadora Arredondo, global policy director at Hedera, told Cryptonews that MiCA has given the crypto sector the credibility it has long been asking for.

“MiCA will help build the guardrails for European investors and consumers to engage safely and confidently with the market,” Arredondo said. “This should hopefully propel innovation forward, rather than stifle it.”

Are Global Standards Underway?

Given the US and Europe’s involvement in regulating digital assets, there is a possibility that global standards within the crypto industry may soon emerge. Whether those regulations will stem from US policy or MiCA is yet to be determined.

Laurenth Alba, head of business development at Rome Protocol and legal consultant, told Cryptonews that MiCA is a regulatory benchmark, but it won’t automatically become a global standard.

“MiCA’s clear framework for stablecoins, exchanges, and compliance provides much-needed clarity, something jurisdictions like the US still lack,” Alba said. “However, global adoption is unlikely because different economies have unique financial systems and regulatory philosophies.”

Alba pointed out that the US relies on enforcement-first tactics, while Asia-Pacific (APAC) markets lean toward sandbox models.

“The real test is whether MiCA proves effective in balancing security, innovation, and enforcement – if it does, it may serve as a model for other jurisdictions, but not a one-size-fits-all approach,” she commented.

George Georgiades, general counsel at Borderless.xyz – a stablecoin payments network – added that certain legislation coming from MiCA may eventually be adopted by other regions.

For instance, he noted that MiCA’s framework addresses key issues currently being considered in the US.

“From the SEC’s ‘Crypto Task Force’ to the introduction of the ‘GENIUS’ bill, regulatory clarity around stablecoins is gaining momentum,” Georgiades said.

Given this, he believes that any final legislation will likely mirror certain key aspects of MiCA.

“This includes defining stablecoins as currency-backed (excluding RWA and algorithmic models) and incorporating consumer protections, such as reserves and transparency requirements,” Georgiades remarked.

However, Alba explained that MiCA’s main focus is on centralized exchanges. This leaves a hole for decentralized finance (DeFi).

“With DeFi largely unregulated, this can lead to loopholes for bad actors to exploit,” she said. “There would have to be amended frameworks for DeFi laws that wouldn’t stifle their innovation under MiCA.”

Alba added that if other economies do not engage in cross-border dialogue, achieving global harmony could prove to be a difficult task.

Stablecoins Key Sector To Watch

While US regulations and MiCA may eventually shape global standards, a key area to watch will be stablecoins. Both MiCA and US legislation attempt to define the role of stablecoins, demonstrating the importance of these digital assets.

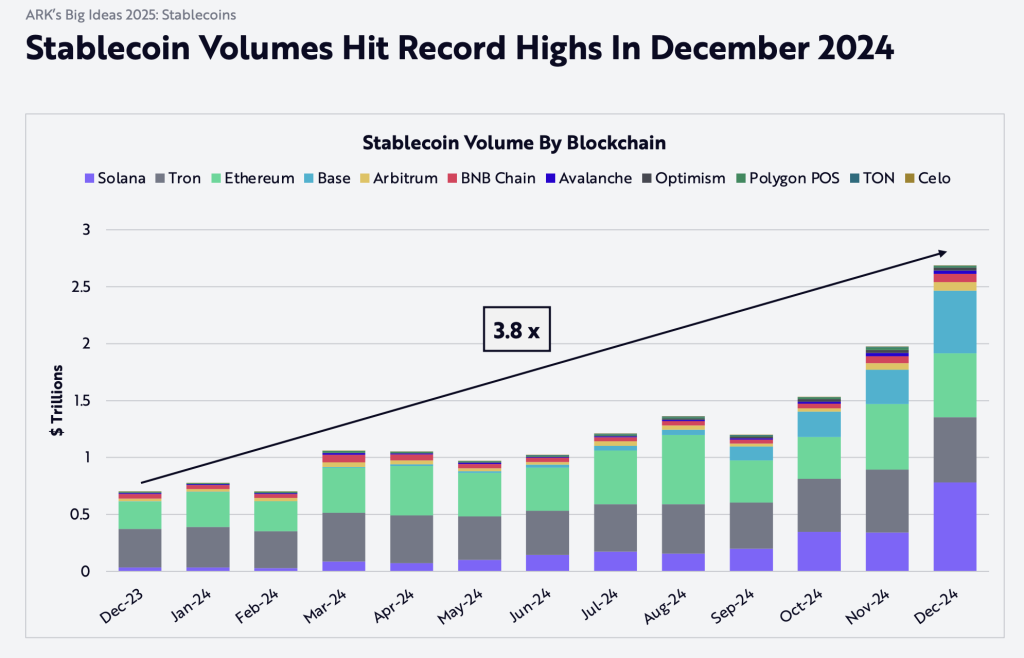

New research from Ark Invest shows that stablecoin volume is increasing. According to Ark Invest’s “Big Ideas 2025” report, December 2024 set new records for stablecoins, with a daily volume of $270 billion and a monthly volume of $2.7 trillion.

Eli Cohen, general counsel at Centrifuge, told Cryptonews that the US is moving to regulate stablecoins with the introduction of a stablecoin bill by Senator Bill Hagerty.

Senator Hagerty, a Tennessee Republican, said in a Feb. 4 statement that the stablecoin bill would create “a safe and pro-growth regulatory framework that will unleash innovation.” This bill may also advance President Donald Trump’s pledge to make the US the “world capital of crypto.”

Meanwhile, MiCA is enforcing stringent regulations around stablecoins. While cryptocurrency exchanges operating in the EU have begun delisting non-compliant stablecoins, companies such as Circle – issuer of USD Coin (USDC) – have obtained an e-money license in France.

“The main open question is how stablecoin rules under MiCA or in the US can be enforced in what is essentially a globalized market,” Cohen said.

Will Crypto Thrive Under US Regulations or MiCA?

While it’s worth acknowledging that the crypto sector is becoming regulated, it remains questionable as to which regions will be most favorable for innovation.

Chrissy Hill, chief legal officer and Interim chief operating officer at Parity Technologies, told Cryptonews that he believes President Trump has already undermined years of work by the EU to ensure the US becomes the most attractive jurisdiction for crypto in the world.

“By taking a contrary stance to MiCA on key issues like the treatment of stablecoins and Central Bank Digital Currencies (CBDCs), the US is foreshadowing its business-friendly approach,” Hill said. “Combine that with the new administration’s general stance on deregulation, focus on bicameral cooperation and key appointments, it seems as if the EU will be less attractive and more expensive to do business in.”

Hill added that the cost of compliance for crypto companies to operate in the EU may stifle innovation.

For instance, while large institutions may view MiCA as a gateway to regulatory legitimacy, startups may think otherwise.

Echoing this, Alba said that while MiCA creates clear paths for compliance, its stringent requirements could favor larger, well-capitalized firms.

“Smaller projects with limited legal resources may struggle to navigate the licensing and disclosure requirements, forcing them to either consolidate under larger entities or relocate to more permissive jurisdictions,” she remarked.

Although this may be, Alba thinks US investors may view MiCA as a benchmark for regulatory clarity – given that the US has experienced fragmented regulation and enforcement methods over the past few years.

She therefore believes that MiCA’s clear regulation on stablecoins and exchanges should be viewed as a positive development that can secure market stability and protect consumers from bad actors.

Alba added that there may be worry from US-based crypto companies and investors that Europe could emerge as the new crypto hub. “It will be a wait-and-see moment until there is regulatory clarity enforced in the US,” she said.

As both the US and the EU continue refining their crypto frameworks, market participants around the world will be watching closely to see how these regulations shape innovation, consumer protection, and the broader industry’s growth

The post US Crypto Regulations vs. MiCA Rules: Are Global Standards Underway? appeared first on Cryptonews.

News – Read More

President Trump signing the executive order for a sovereign wealth fund could be a positive signal towards the concept of a long-desired U.S. strategic Bitcoin reserve.

President Trump signing the executive order for a sovereign wealth fund could be a positive signal towards the concept of a long-desired U.S. strategic Bitcoin reserve. NEW: Today

NEW: Today