- Bitcoin has rebounded to $83,000 after dipping below $80,000 earlier this week. A further increase above $84,000 could set the path for the uptrend.

- Altcoins are exhibiting a bullish outlook despite recent volatility. Analysts suggest that the upward-trending market structure presents dip-buying opportunities.

All eyes are currently on the release of the U.S. Consumer Price Index (CPI) reports coming later on Wednesday, which will set the tone for the ned Federal Reserve monetary policy decisions. Bitcoin and the broader crypto market seem to be entering a bit of consolidation at the moment, waiting for clear signals ahead.

US CPI and Inflation Expectations for 2025

Top market analysts are predicting a major decline in both headline and core inflation numbers for the last month of February 2025. This would be the first drop in both the indicators in eight months, since July 2024. In January 2025, core inflation edged up from 3.2% to 3.3%. For February, consensus estimates suggest a reversal, with the rate expected to dip back to 3.2%. TEForecast projects a more significant decrease, forecasting a drop from 3.3% to 3.1%.

The broader market consensus is that the US inflation numbers will decrease significantly, with expectations of the headline CPI dropping to 2.9%. Notably, Kalshi traders have accurately predicted 6 out of the last 8 CPI figures, bolstering confidence in their projection.

Additionally, analysts at QCP Capital noted that market volatility has shot up significantly, with the Volatility Index (VIX) spiking to 28 before easing to 26.6. The Cboe VIX term structure’s shift into backwardation suggests a potential market floor. All eyes are now on tonight’s CPI report, which could shape rate expectations. Markets have moved from pricing in one Fed rate cut in January to four cuts this year.

Bitcoin and Crypto Market Action Ahead

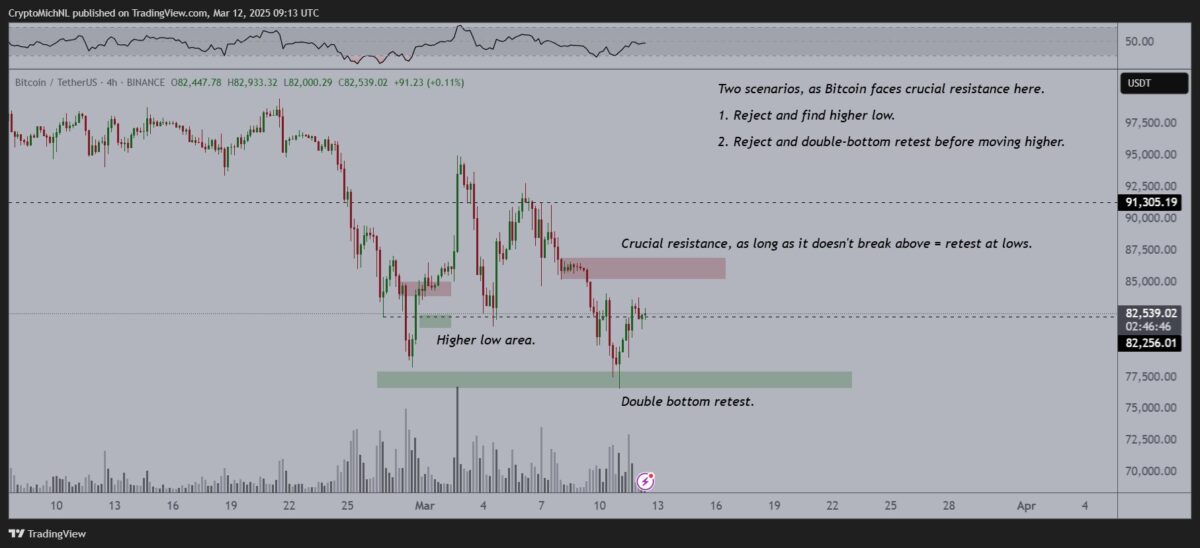

Following the drop under $80,000 earlier this week, Bitcoin’s price has bounced back once again while reclaiming $83,000 levels once again. If the US inflation numbers turn favourable for the markets, BTC could reclaim the upward trajectory quickly, printing further gains from here, as highlighted in our previous news article.

Prominent crypto analyst Michael van de Poppe has expressed optimism about Bitcoin’s current price action. He said that the BTC chart shows optimism despite the current volatility. Van de Poppe suggested that retesting the $84,000 level could pave the way for a new high, potentially signaling a reversal in the broader market trend.

“To be honest, the chart isn’t bad on Bitcoin,” he commented. “Test $84K again, make a new high, and we might be reversing the trend.”

On the other hand, altcoins are also showing signs of trend reversal after a brutal crash, as detailed in our last news piece. Crypto analyst Michael van de Poppe has highlighted a bullish outlook for altcoins, noting that the market structure remains upward trending despite recent price fluctuations. In a recent statement, van de Poppe remarked: “The structure is still upwards trending, which means that it’s in dip-buying area for the altcoins.”

Crypto News Flash – Read More