Ethereum price aimed to surge past the $2,000 mark, signaling renewed market activity. Large investors, commonly referred to as whales, have been making major moves, transferring substantial amounts of ETH from exchanges and into lending protocols.

This movement has drawn attention from analysts who suggest that Ethereum could be entering a bullish phase.

Whales Withdraw ETH and Borrow USDT

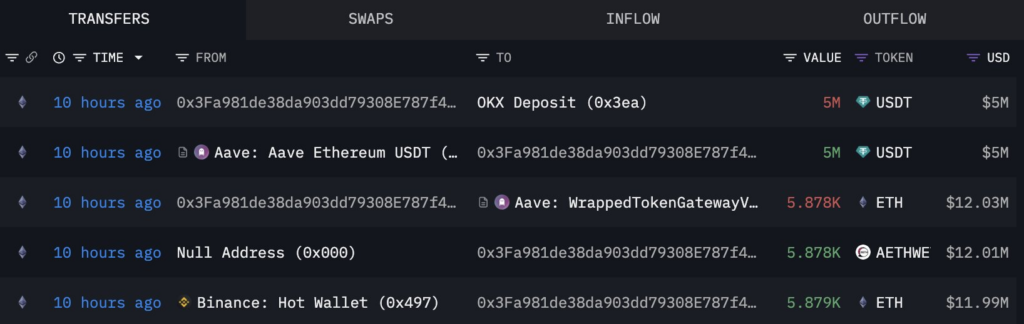

Lookonchain analytics platform stated that three large wallets withdrew 14,217 ETH-$29 million from Binance. Conventionally, instead of having the tokens, they invested them in Aave, a decentralized lending platform.

After that, the whales borrowed $12 million in USDT and sent it to various exchanges, indicating possible buying.

Such flows tend to reflect changes in market sentiment since whales tend to move before large price swings occur. These transactions occurred at a time when Ethereum price was trying to go above the resistance level of $2000.

Some are optimistic that this could be the start of a better week and better days ahead if buying interest persists.

Merlijn The Trader, a crypto analyst, described the price movement as a breakout from a “massive symmetrical pattern.” He suggested that this setup could lead to an extended rally, comparing it to previous bullish cycles in Ethereum’s history.

Ethereum’s Price Action and Technical Indicators

Ethereum has struggled with price resistance near the $2,000 level for several weeks. Recent trading activity has shown a breakout beyond this barrier, leading to an increase in bullish sentiment.

As for technical indicators, the Relative Strength Index (RSI) stands at 66, implying that ETH is on the rise but not yet overbought.

Moreover, the MACD line has crossed above the signal line, signaling the possible continued upward trend as forecasted. If Ethereum holds above $2,000, it might proceed to the next levels of resistance.

According to a crypto analyst named Ted, there are recent signals that mean that Ethereum is out of a short-term accumulation phase. He stated that Ethereum ranged between $1,800 and $3,000 for quite a long time, but the current price movement indicates the longer-term bullish trend may be in the making.

In the past weeks, Ethereum has faced a breakout of the upper Bollinger band, which could press on to try previous higher highs in the forthcoming weeks.

Coinbase Becomes Ethereum’s Largest Node Operator

As Ethereum’s price gains momentum, changes in its staking landscape have also become apparent. Coinbase has emerged as the largest node operator on the Ethereum network, controlling 11.42% of all staked ETH.

According to the company’s latest report, it currently holds 3.84 million ETH, valued at over $6.8 billion.

Anthony Sassano from The Daily Gwei also highlighted that despite Lido staking collective being the most dominant, no single member of Lido possesses as much stake as Coinbase.

As for centralization issues, it is crucial to notice that Coinbase pointed out that their validators are geographically distributed in Japan, Singapore, Ireland, Germany, and Hong Kong.

The validators of Coinbase ensure that the network achieves a 99.75% uptime, which is noticeably higher than average. This performance metric is very important to enhance the proper running of Ethereum’s proof-of-stake system.

Following the current development of Ethereum that shifts focus to a more efficient blockchain environment, institutions such as Coinbase are becoming more significant.

The post Whales Move ETH: Can Ethereum Price Breaks Past $2,000? appeared first on The Coin Republic.

The Coin Republic – Read More