SEC Shifts Approach on XRP’s Status

According to FOX News correspondent Charles Gasparino, the SEC is using Ethereum’s regulatory treatment as a benchmark in determining XRP’s classification. The agency’s reassessment could signal a softening stance on crypto enforcement following years of legal battles.

This development follows the July 2023 ruling by U.S. District Judge Analisa Torres, which declared that XRP is not inherently a security—a landmark decision that weakened the SEC’s case against Ripple. Now, regulators appear to be considering a different approach, which could mark a significant turning point for XRP and its investors.

The XRP price is up 4.5% overnight, Source: XRPLX

Ethereum’s Regulatory Status Becomes a Key Reference

Ethereum’s status as a “pure commodity” has emerged as a crucial reference point in XRP’s legal battle. While Ethereum initially raised funds through an Initial Coin Offering (ICO), it has since been granted commodity classification, allowing its ecosystem to operate with far less regulatory scrutiny.

This precedent raises key questions:

- If Ethereum is considered a commodity, should XRP be treated the same way?

- Could this shift in classification pave the way for XRP-based exchange-traded funds (ETFs)?

Regulatory Uncertainty Delaying XRP ETFs

Bloomberg ETF analyst James Seyffart has previously noted that regulatory clarity is the biggest hurdle preventing the approval of XRP ETFs. In a January interview, Seyffart pointed out that similar challenges exist for Solana (SOL), which remains classified as a security by the SEC.

Until Ripple’s legal battle is fully resolved, the SEC is unlikely to greenlight any spot XRP ETFs. However, if XRP is officially reclassified as a commodity, ETF approvals could move forward rapidly, much like Bitcoin’s recent spot ETF approval.

SEC vs. Ripple Lawsuit Nears Conclusion

According to FOX journalist Eleanor Terrett, the SEC and Ripple are now in the final stages of settlement discussions. Sources indicate that the new SEC leadership may be seeking a clean slate for crypto enforcement. Terrett reports that Ripple’s legal team is negotiating adjustments to the $125 million fine imposed in the original ruling. Discussions are also underway to revise restrictions on XRP sales to institutional investors, aligning them with recent shifts in SEC policy.

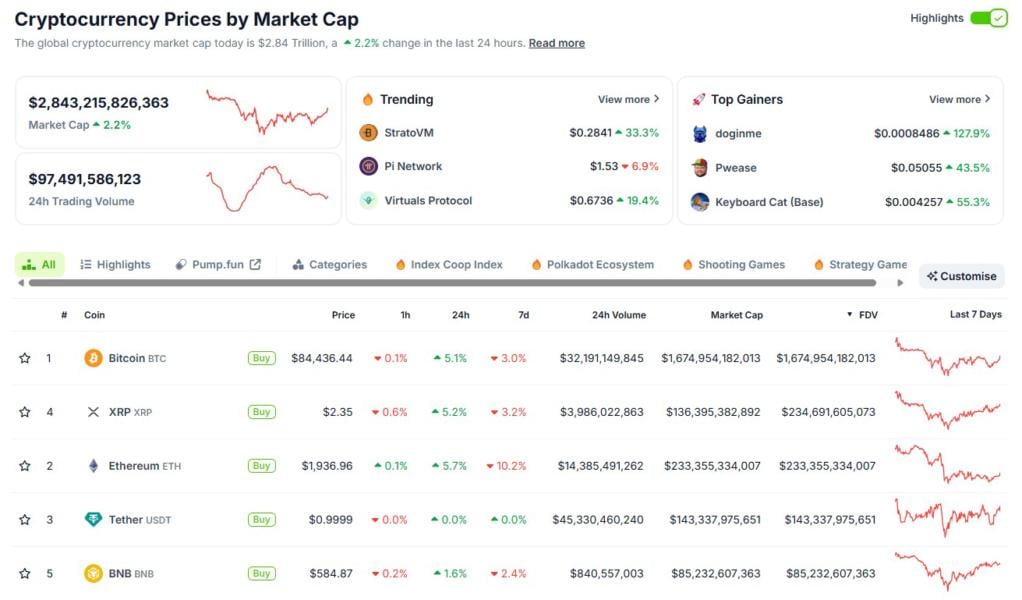

XRP’s Fully Diluted Valuation Surpasses Ethereum Amid Market Shake-Up

Meanwhile, XRP’s fully diluted valuation (FDV) has officially surpassed Ethereum (ETHUSD), according to CoinGecko data.

This milestone highlights two key trends:

- XRP Ledger’s growing DeFi traction as institutional interest surges.

- Ethereum’s mounting competition from faster, cheaper alternatives like Solana.

By the Numbers:

- XRP FDV: $235 billion (over $1 billion more than Ethereum’s).

- ETH FDV: Slightly below $234 billion.

- Ethereum still leads in market cap: $233 billion vs. XRP’s $136 billion.

FDV measures the total value of all tokens if fully unlocked, while market cap reflects only the circulating supply. Ripple Labs still holds a massive allocation of XRP, influencing its FDV calculation.

XRP has flipped ETH by FDV, Source: Coingecko

XRP’s Meteoric Rise & Regulatory Tailwinds

Since Donald Trump’s re-election victory on Nov. 5, XRP’s price has soared over 300%, currently trading around $2.30 per token.

Trump’s pro-crypto stance has been a game-changer, with his administration vowing to make the U.S. a global crypto hub. His key appointments to regulatory agencies have signaled a shift away from aggressive enforcement, benefiting assets like XRP.

XRP’s institutional DeFi expansion, announced in February, further cements its role in enterprise adoption. Its native decentralized exchange (DEX) has already processed $1 billion in swaps since launching in 2024.

The bullish sentiment around XRP intensified when Trump revealed plans to include XRP in a proposed U.S. Digital Asset Stockpile—a reserve of seized cryptocurrencies held by law enforcement. Solana (SOL) and Cardano (ADA) are also included, but no new crypto purchases will be made. Ripple CEO Brad Garlinghouse is close to the White House and has had several meetings with Trump and crypto czar David Sacks.

What’s Wrong With Ethereum?

While XRP thrives, Ethereum has struggled since its Dencun upgrade in March 2024, which slashed transaction fees by 95%. The ETH/BTC ratio continues to drop, Ethereum can’t find its footing.

Solana’s explosive growth has diminished Ethereum’s dominance, especially in the meme coin frenzy of 2024. Solana’s trading volume now rivals Ethereum and all its layer-2 solutions combined.

XRP’s FDV surpassing Ethereum underscores a changing crypto landscape, where regulatory clarity, institutional DeFi, and pro-crypto leadership are shaping new market dynamics.

With a Ripple settlement on the horizon, a growing DeFi ecosystem, and Trump’s crypto-friendly stance, XRP’s momentum looks far from over. Meanwhile, Ethereum faces increasing competition from faster, lower-cost alternatives—raising questions about its long-term dominance.

A settlement that officially classifies XRP as a commodity could be a game-changer for Ripple and the broader crypto industry. Not only would it clear the path for XRP ETFs, but it would also establish stronger legal precedent for other blockchain projects facing similar regulatory scrutiny.

Brave New Coin – Read More