This milestone has fueled speculation about XRP’s potential to break past previous highs, with investors closely watching regulatory developments and market sentiment.

Grayscale’s XRP ETF Review Underway

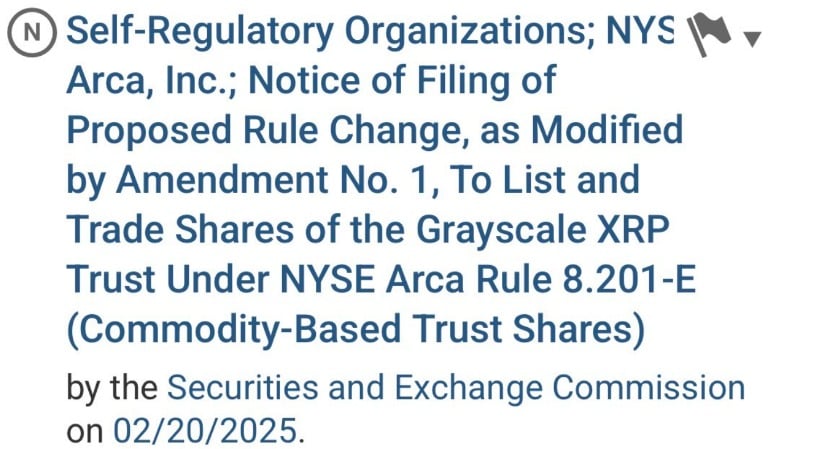

Grayscale’s XRP ETF filing is now officially posted to the Federal Register, opening up a 240-day review period at the SEC. As part of regulatory procedure, there is now a requirement for a 21-day public comment period, during which market participants can provide comments. SEC will then consider the proposal, factoring in concerns of investor protection, the health of the market, and securities law compliance before issuing a final decision by October 18, 2025.

Grayscale’s XRP ETF filing is now in the Federal Register, starting the SEC’s review process with a deadline of October 18. Source: Eleanor Terrett via X

The regulatory status of XRP remains a major factor in the approval process. The SEC’s extended case against Ripple Labs, which was based on whether XRP is a security, has left regulatory uncertainty over the asset. Historically, the SEC has been conservative with altcoin ETFs due to concerns over market manipulation. Current legal and regulatory changes may improve the chances of approval.

The countdown has begun for the first U.S. XRP ETF approval. Source: Eleanor Terrett via X

XRP Price Targets Key Resistance Levels

XRP’s price has responded positively to the ETF news, with traders eyeing a breakout above the $3.00 resistance level. Technical analysts suggest that overcoming this barrier could trigger a significant rally.

Exceeding the $3 resistance remains a key challenge for XRP. Source: Nurulk69 on TradingView

Crypto analyst Dark Defender recently projected that XRP could first test $2.77 before making a push beyond $3.00. Another trader, CasiTrades, noted, “XRP continues to hold inside a corrective channel, which is typical for a Wave 4,” hinting at an approaching all-time high.

Institutional Interest in XRP Grows

The heightened institutional demand for XRP-denominated products has been one of the key drivers of bullishness. In a first-ever occurrence, Brazil stands as the first nation to have recently authorized an XRP spot ETF, an enormous step towards institutional mainstream adoption.

While all this is taking place, news has emerged of rumors that giants like Bank of America are experimenting with using XRP in cross-border transactions. Though no confirmation has been made, such rumors have further entrenched the positive sentiment for the digital currency.

Regulatory Landscape Shifts in XRP’s Favor

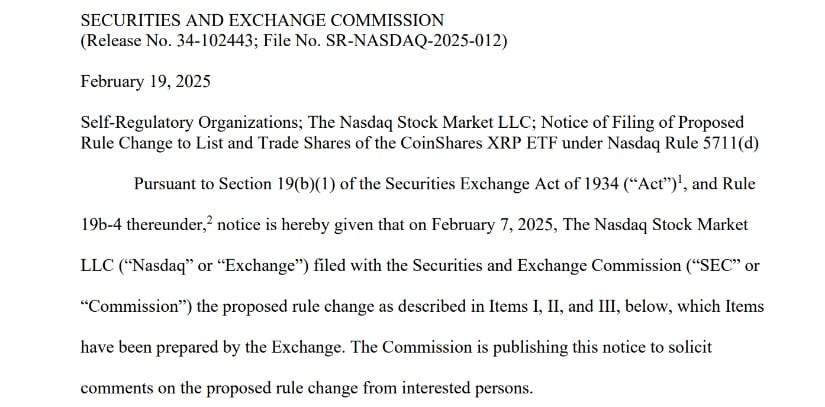

The SEC has been reviewing multiple XRP ETF applications alongside Grayscale’s filing. On February 19, the agency acknowledged filings from CoinShares, Canary, and WisdomTree, submitted through major exchanges like Nasdaq and Cboe BZX.

The SEC has acknowledged WisdomTree’s XRP ETF application, initiating a 21-day public comment period. Source: SEC/Gov

Furthermore, the SEC’s recent decision to disband its crypto enforcement unit and reassign key personnel has raised questions about its regulatory direction. Legal experts believe this restructuring may signal a more lenient stance toward digital assets. Former SEC Office of Internet Enforcement Chief John Reed Stark commented, “The SEC’s latest reorganization could indicate a shift in focus away from non-fraud crypto cases.”

This potential policy shift, coupled with pro-crypto sentiment in the current U.S. administration, has heightened expectations that regulatory hurdles for XRP and other digital assets could ease in the coming months.

XRP ETF Approval Odds and Market Impact

Market data suggests growing confidence in the likelihood of an XRP ETF approval. Polymarket, a predictions market website, is currently displaying an 81% likelihood of approval. An approved XRP ETF would bring in huge liquidity and institutional inflows, potentially taking the price to new all-time highs.

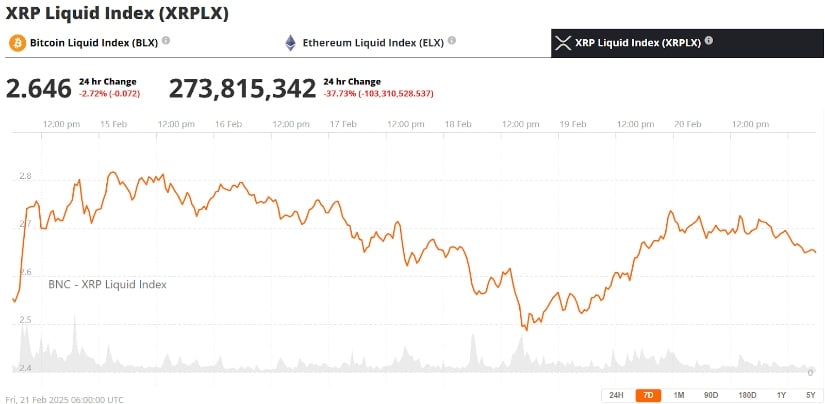

Ripple (XRP) was trading at around $ 2.64, down 2.72% in the last 24 hours at press time. Source: XRP Liquid Index (XRPLX) via Brave New Coin

Despite the optimism, there are cautionary notes coming from some analysts. Azura CEO Jackson Denka warned, “Until we see real adoption and actual progress of XRP’s blockchain use cases, it is difficult to say whether this price surge is sustainable.”

Watch – XRP Price Analysis Video

Looking Ahead

With the SEC review now in motion, the next few months will be pivotal for XRP. A favorable regulatory outcome could push XRP beyond its previous peak of $3.55 and toward new highs. Conversely, if the SEC rejects the ETF application or prolongs the legal uncertainty surrounding Ripple, market enthusiasm could wane.

Investors and industry participants will be closely monitoring regulatory developments, institutional adoption trends, and price movements as XRP navigates a potentially transformative period.

Brave New Coin – Read More