His remarks came in response to claims that Bitcoin’s scarcity gives it an edge over XRP, fueling a larger discussion about how cryptocurrencies should be evaluated.

XRP vs. Bitcoin: The Supply Argument

The debate escalated when an XRP enthusiast mentioned that Ripple executives, such as CEO Brad Garlinghouse and CTO David Schwartz, never directly instructed people to buy XRP—something Bitcoin enthusiasts like MicroStrategy’s Michael Saylor have constantly done when they position Bitcoin as the superior store of value.

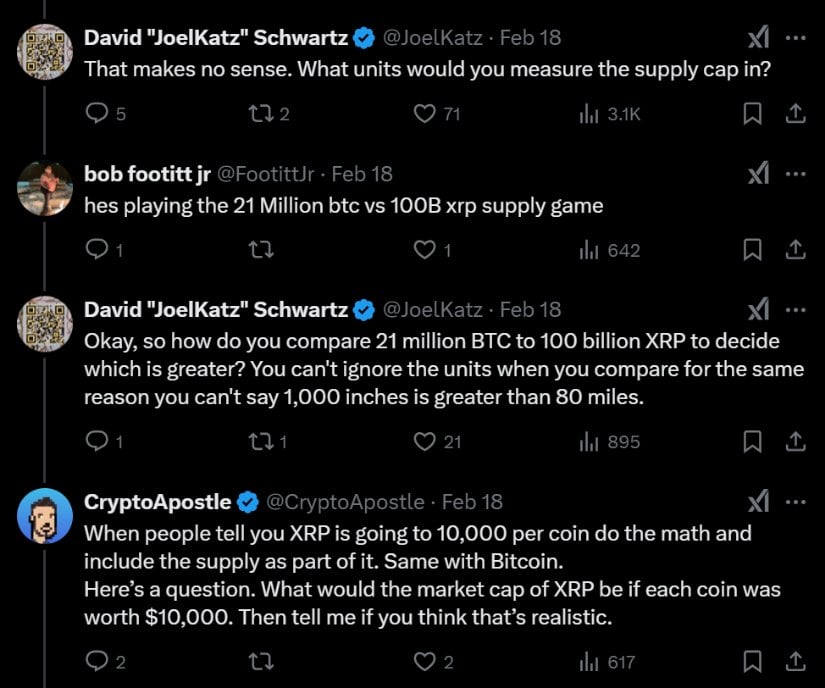

CryptoApostle cited Bitcoin’s scarcity as a key advantage, but Ripple CTO David Schwartz countered, calling supply-based comparisons misleading. Source: CryptoApostle via X

A crypto analyst with the pseudonym CryptoApostle responded by pointing out Bitcoin’s limited 21 million supply compared to XRP’s 100 billion tokens. He was of the view that this simple difference makes it necessary to actively promote Bitcoin, the implication being that XRP lacks such limits. This form of argument adopts a general position that Bitcoin’s limited supply pushes its “digital gold” status, while XRP with the higher supply tends to be viewed as less scarce.

Schwartz Calls Out Faulty Comparisons

Schwartz pushed back against this reasoning, arguing that comparing cryptocurrencies based on supply or unit price alone is flawed. He explained that evaluating assets by “full coins” rather than considering market capitalization, divisibility, or overall utility leads to a distorted view of their actual worth.

Schwartz dismissed supply comparisons between XRP and Bitcoin as misleading without unit context. Source: X

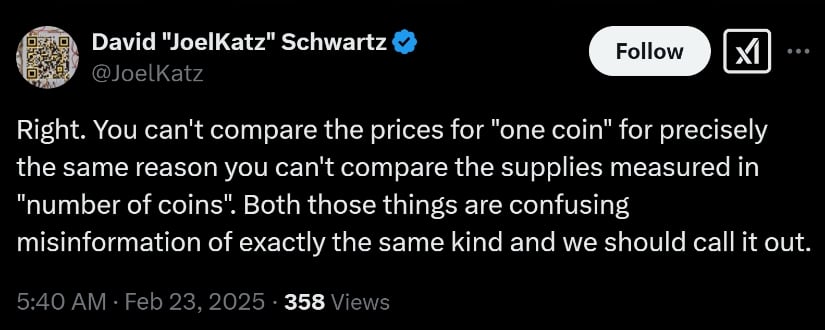

“You can’t compare the prices for ‘one coin’ for precisely the same reason you can’t compare the supplies measured in ‘number of coins,’” Schwartz stated, likening such comparisons to measuring distances in inches versus miles. He emphasized that dividing XRP into smaller units—called drops—allows for similar functionality as Bitcoin’s satoshis, making unit supply an ineffective measure of value.

CryptoApostle, however, maintained that retail investors naturally think in terms of whole coins rather than micro-units like satoshis or drops. He also pointed out that while Ripple executives do not directly promote XRP, the company’s partnerships with banks and financial institutions serve as an indirect form of marketing.

Breaking the “Cheaper Coin” Misconception

One of the primary issues Schwartz raised is the tendency of some investors to view XRP as a “better buy” simply because it appears cheaper per unit than Bitcoin. This fallacy, he explained, disregards the total economic forces that determine an asset’s true value.

David Schwartz criticized price and supply comparisons between XRP and Bitcoin, calling them misleading and misinformative. Source: JoelKatz via X

Market cap—the total combined amount of all coins in existence—is a steadier metric to use when gauging the worth of a cryptocurrency, yet most new buyers are swept up in price per coin comparisons with no consideration given to overall supply. Schwartz has long cautioned against such superficial comparisons, urging buyers to look at more than shallow figures.

XRP’s Role in the Crypto Market

The debate over XRP’s value comes at a time when the cryptocurrency remains in the spotlight for multiple reasons. Ripple’s ongoing legal battle with the U.S. Securities and Exchange Commission (SEC) has added regulatory uncertainty to XRP’s outlook, affecting investor sentiment.

Additionally, speculation about a potential XRP exchange-traded fund (ETF) has gained traction, especially as the SEC re-evaluates its stance on crypto-based financial products. If XRP secures ETF approval, it could further cement its role as a mainstream digital asset, potentially shifting the perception that it lacks the scarcity-driven appeal of Bitcoin.

XRP was trading at around $2.55, down 1.21% in the last 24 hours at press time. Source: XRP Liquid Index (XRPLX) via Brave New Coin

Meanwhile, XRP’s price movements have remained volatile. After a recent sell-off, XRP rebounded above $2.50 but continues to struggle against broader market trends. Analysts believe its trajectory largely depends on regulatory clarity and the SEC’s upcoming decisions.

The Bigger Picture

Schwartz’s latest comments reinforce a broader lesson for the crypto market: simplistic comparisons between digital assets can be misleading. Whether assessing XRP, Bitcoin, or any other cryptocurrency, investors must consider market cap, divisibility, use cases, and network utility rather than just supply figures or price per coin.

As the crypto industry matures, discussions like these highlight the importance of informed decision-making. While Bitcoin and Ripple’s XRP serve different roles in the financial ecosystem, their fundamental value should be measured by real-world adoption and market fundamentals rather than arbitrary unit-based comparisons. For those investors wondering what crypto to buy now, Bitcoin is the safer bet. It is a proven store of value and it is being adopted by institutions via the many Bitcoin ETFs. However, XRP might have more dramatic upside potential – if XRP spot ETFs are approved, or if Trump does something to support Ripple’s made-in-America status. Savvy investors could hold both.

Watch – XRP Price Analysis Video

Brave New Coin – Read More