However, traders, particularly in South Korea, swiftly bought the dip, pushing the price back above the crucial $2 mark. Analysts believe aggressive spot buying played a pivotal role in stabilizing XRP’s value despite the overall bearish sentiment in the market.

XRP’s Swift Recovery Amid Market Turmoil

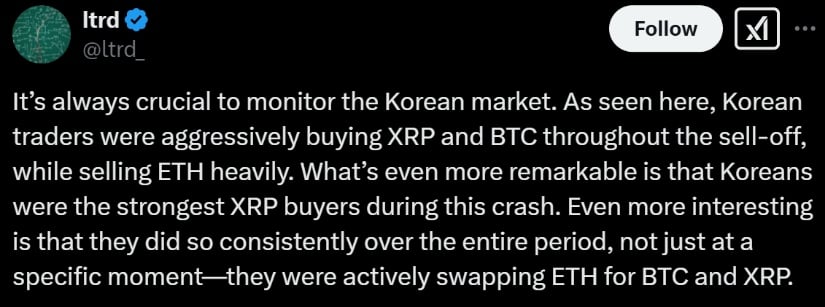

Korean traders aggressively bought XRP and BTC during the sell-off while offloading ETH. Source: LTRD via X

An anonymous market analyst, known as “Itrd” on X, noted that Korean traders were instrumental in XRP’s rebound. “They were actively swapping ETH for BTC and XRP, consistently accumulating over the entire period, not just at a specific moment,” the analyst observed.

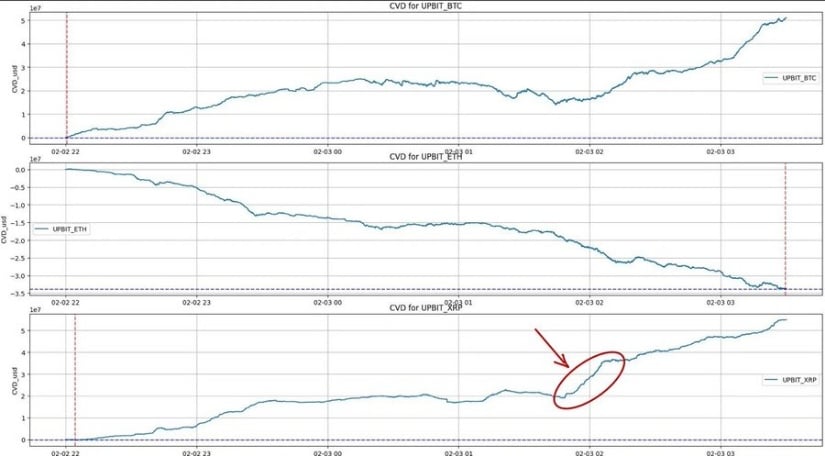

XRP CVD spiked between 2:00 and 3:00 UTC on February 3, confirming strong dip buying. Source: LTRD via X

Data from Upbit, South Korea’s largest crypto exchange, suggests that significant buy bids were placed below $2, contributing to the quick price recovery. The cumulative volume delta (CVD), a metric that tracks net buying and selling activity, saw a sharp increase between 2:00 and 3:00 UTC on February 3, reinforcing the notion that buyers took advantage of the dip.

Whale Activity Signals Possible Profit-Taking

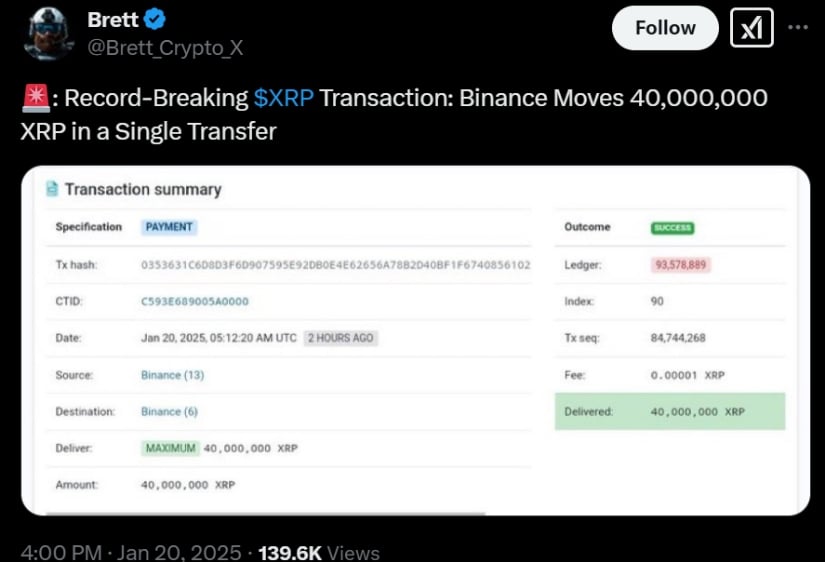

Despite the strong spot demand, on-chain data indicates that XRP whales have been offloading significant holdings. CryptoQuant reported that over 180 million XRP tokens were moved to Binance in more than 15,000 transactions over the past day—the largest whale-to-exchange movement since January 8.

A record-breaking transaction saw Binance move 40,000,000 XRP in a single transfer. Source: Brett via X

This selling pressure from large holders could impact short-term price action, especially if retail buying momentum slows. However, it remains uncertain whether these whale transfers are purely for profit-taking or part of a broader market repositioning.

Open Interest Plummets as Leverage Gets Wiped Out

The derivatives market also saw a notable shift. XRP’s open interest (OI) across all exchanges plunged by 44% in February, dropping from $6.35 billion on February 1 to $3.55 billion. This indicates that leveraged traders were forced to exit their positions following the price drop.

Ripple XRP chart showing Open Interest and Aggregated Open Interest data. Source: Velo

A sharp decline in open interest often suggests a “reset” in the market, potentially paving the way for more organic price movements. Additionally, funding rates have returned to neutral, implying that excessive leverage has been flushed out.

Technical Outlook: Can XRP Maintain Its Momentum?

From the technical point of view, XRP is in a falling channel pattern, where both the 50-day and 100-day EMAs resist. According to analysts, $2.20-$2.33 could work as a strong demand zone as this area had seen good buy interest in the past.

The XRP price must develop a bullish momentum above the $2.50 resistance to open the door for further gains. Source: BitcoinGalaxy on TradingView

If XRP manages to hold above this region, the push toward $2.50 or higher is very possible. Otherwise, unable to keep the momentum going, in a few weeks it may rechallenge the $2 level again.

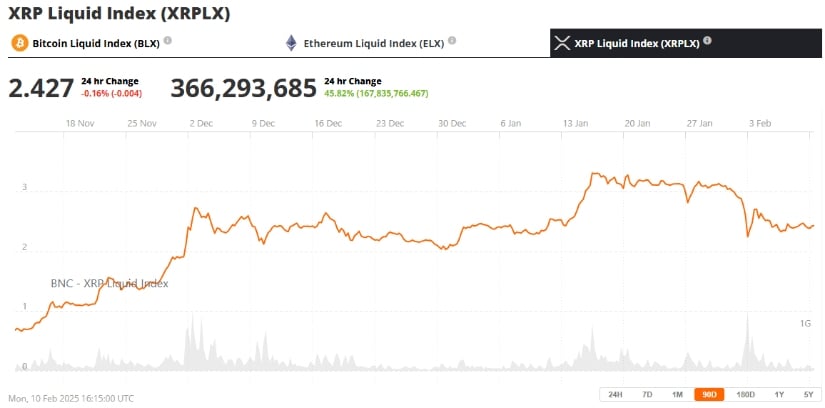

Ripple (XRP) was trading at around $2.42, up 0.16% in the last 24 hours at press time. Source: XRP Liquid Index (XRPLX) via Brave New Coin

Market sentiment remains cautiously optimistic despite the recent volatility. The long-term bullish structure of XRP would remain intact as long as the price remains above the 200-day moving average, which currently lies around $1.30.

Ripple Vs The SEC Update

Meanwhile, the protracted legal battle between Ripple Labs and the U.S. Securities and Exchange Commission (SEC) has taken intriguing turns recently. Notably, the SEC reassigned Jorge Tenreiro, a key figure in its crypto enforcement unit overseeing the Ripple case, to another department. This move has fueled speculation that the SEC might be softening its stance, potentially paving the way for a resolution favorable to Ripple.

Despite these developments, XRP’s price has not responded as anticipated. Over the past week, XRP has declined by approximately 24%, trading around $2.40. This downturn is puzzling, especially given the positive legal shifts. Analysts suggest that broader market bearishness, particularly Bitcoin’s struggle to maintain key support levels, may be influencing XRP’s performance.

Ripple’s Chief Legal Officer, Stuart Alderoty, remains optimistic, citing leadership changes within the SEC as a potential catalyst for more crypto-friendly regulations. Legal experts also note the SEC’s recent decision not to oppose Coinbase’s motion for an interlocutory appeal, interpreting it as a possible relaxation of the agency’s stringent stance on crypto-related cases.

While Ripple appears to be making headway in its legal confrontation with the SEC, XRP’s price has yet to reflect these positive developments, likely due to overarching market conditions.

Final Thoughts

XRP’s price action continues to reflect the broader crypto market’s uncertainty. While strong spot buying has helped the altcoin recover from its lows, whale activity and reduced leverage suggest a cautious outlook. Whether XRP can sustain its bullish momentum depends on its ability to hold key support levels and attract renewed buying interest in the coming days. If you are wondering what crypto to buy now, XRP remains a strong asset for consideration.

Brave New Coin – Read More